Suppose the forward rate volatility under the one-factor HJM model takes the form show that the Jamshidian

Question:

Suppose the forward rate volatility under the one-factor HJM model takes the form

![OF(t, T) = 01 +0[1 - e-(T-1)],](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/3/6/033655da581cca211700636033410.jpg)

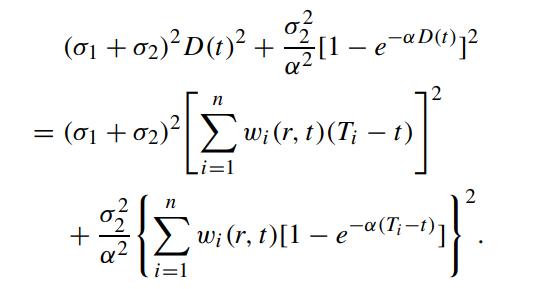

show that the Jamshidian decomposition technique (Jamshidian, 1989) cannot be used to price an option on a coupon bearing bond with coupon payment date Ti,i = 1, 2, ··· ,n. Find an approximation price formula to the European call option on a coupon bearing bond whose weight wi(r, t) is defined by (8.2.12).

The short rate process under the given volatility structure is non-Markovian. The stochastic duration is the solution D(t) to the following equation

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: