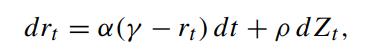

Suppose the short rate r t is governed by the Vasicek model where Z t is a

Question:

Suppose the short rate rt is governed by the Vasicek model

where Zt is a Brownian process under the risk neutral measure Q. Show that the stochastic differential equation of the swap rate Kt[T0,Tn] under the swap measure QS0,n with the annuity numeraire B̂(t ; T0,Tn) is given by (Schrager and Pelsser, 2006)

![dKt[To, Tn] Kt[To, Tn] akt[To, Tn] art p- azon,](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/5/1/350655de156b5a451700651351180.jpg)

where

![akt[To, Tn] art 1 == b(t, T) = D(t, Ti) = - b(t, To) D(t, To) + b(t, Tn)D(t, Tn) + K[To, Tn] ;b(t, T;)D(t,](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/5/1/373655de16d0bce01700651373478.jpg)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: