Question: For solutions of optimization problems from Examples 3.3 analyse sensitivity of. 1. the demand for a production factor and the maximum profit to changes in

For solutions of optimization problems from Examples 3.3 analyse sensitivity of. 1. the demand for a production factor and the maximum profit to changes in a product price and to changes in values of parameters of a production function and of a production cost function, 2. the conditional demand for a production factor and the minimum cost of producing y output units to changes in an output level and to changes in values of parameters of a production function and of a production cost function, 3. the product supply and the maximum profit to changes in a product price and to changes in values of parameters of a production function and of a production cost function.

Examples 3.3

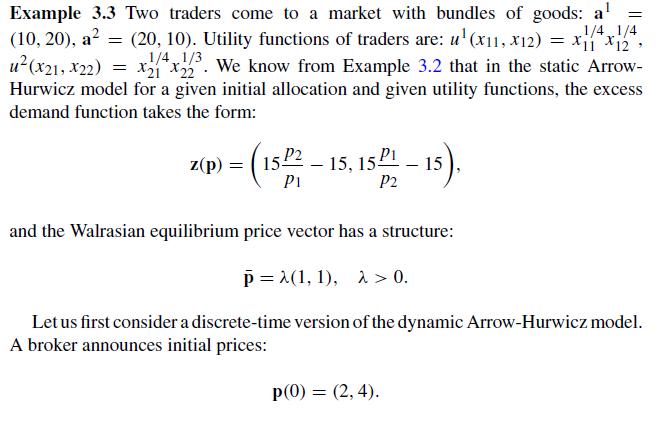

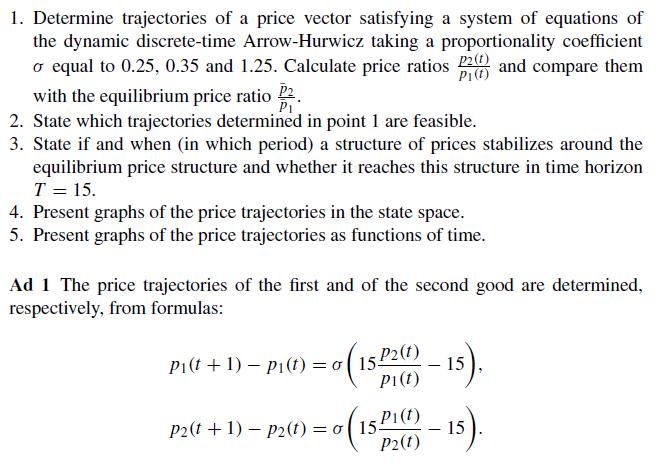

= Example 3.3 Two traders come to a market with bundles of goods: al = X11 X12. 1/4 1/4 (10, 20), a = (20, 10). Utility functions of traders are: u(x11, X12) 1/3 u(x21, x22) = x214x22. We know from Example 3.2 that in the static Arrow- Hurwicz model for a given initial allocation and given utility functions, the excess demand function takes the form: z(p) = (15 P2 - 15, 15P - 15). P1 P2 and the Walrasian equilibrium price vector has a structure: p=(1, 1), > 0. Let us first consider a discrete-time version of the dynamic Arrow-Hurwicz model. A broker announces initial prices: p(0) = (2,4).

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Based on the information provided in the images and the question posed we can address the sensitivity analysis of the various components of an optimization problem within the ArrowHurwicz model contex... View full answer

Get step-by-step solutions from verified subject matter experts