Question: Suppose you believe that over the next five years, stocks will produce returns that are 5 percent worse per year, on average, than the 19732012

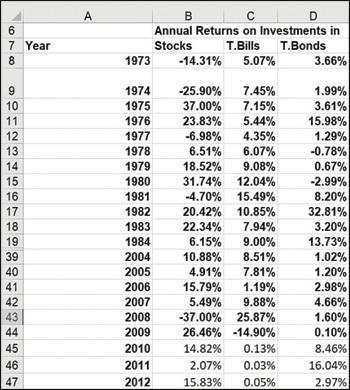

Suppose you believe that over the next five years, stocks will produce returns that are 5 percent worse per year, on average, than the 1973–2012 data. Find an asset allocation among stocks, T-bills, and bonds that yields an expected annual return of at least 6 percent, yet minimizes risk.

6 7 Year 8 9 10 11 12 13 14 15 16 17 18 19 39 40 41 42 43 44 45 46 47 A 1973 B C Annual Returns on Investments in Stocks T.Bills T.Bonds -14.31% 5.07% 3.66% 1974 -25.90% 7.45% 1975 37.00% 7.15% 1976 23.83% 5.44% 1977 -6.98% 4.35% 1978 6.51% 6.07% 1979 18.52% 9.08% 1980 31.74% 12.04% 1981 -4.70% 15.49% 1982 20.42% 10.85% 1983 22.34% 7.94% 1984 6.15% 9.00% 2004 10.88% 8.51% 2005 4.91% 7.81% 2006 15.79% 1.19% 2007 5.49% 9.88% 2008 -37.00% 25.87% 2009 26.46% -14.90% 2010 14.82% 0.13% 2011 2012 2.07% 0.03% 15.83% 0.05% 1.99% 3.61% 15.98% 1.29% -0.78% 0.67% -2.99% 8.20% 32.81% 3.20% 13.73% 1.02% 1.20% 2.98% 4.66% 1.60% 0.10% 8.46% 16.04% 2.97%

Step by Step Solution

3.39 Rating (168 Votes )

There are 3 Steps involved in it

ANSWER To solve this problem we need to use the concept of asset allocation and riskreturn tradeoff Asset allocation refers to the distribution of investment funds among different asset classes such a... View full answer

Get step-by-step solutions from verified subject matter experts