Adams Corporation acquired 90 percent of the outstanding voting shares of Barstow, Inc., on December 31, 2022.

Question:

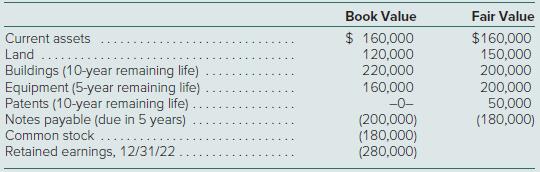

Adams Corporation acquired 90 percent of the outstanding voting shares of Barstow, Inc., on December 31, 2022. Adams paid a total of $603,000 in cash for these shares. The 10 percent noncontrolling interest shares traded on a daily basis at fair value of $67,000 both before and after Adams’s acquisition. On December 31, 2022, Barstow had the following account balances:

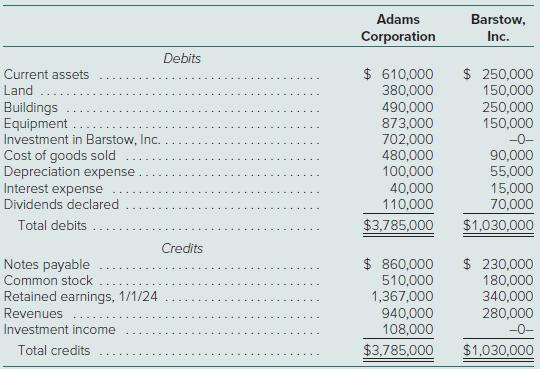

December 31, 2024, adjusted trial balances for the two companies follow:

At year-end, there were no intra-entity receivables or payables.a. Prepare schedules for acquisition-date fair-value allocations and amortizations for Adams’s investment in Barstow.b. Determine Adams’s method of accounting for its investment in Barstow. Support your answer with a numerical explanation.c. Without using a worksheet or consolidation entries, determine the balances to be reported as of December 31, 2024, for this business combination.d. To verify the figures determined in requirement part (c), prepare a consolidation worksheet for Adams Corporation and Barstow, Inc., as of December 31, 2024.

Step by Step Answer:

Fundamentals Of Advanced Accounting

ISBN: 9781266268533

9th International Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik