Jan and Sue have engaged successfully as partners in their law firm for a number of years.

Question:

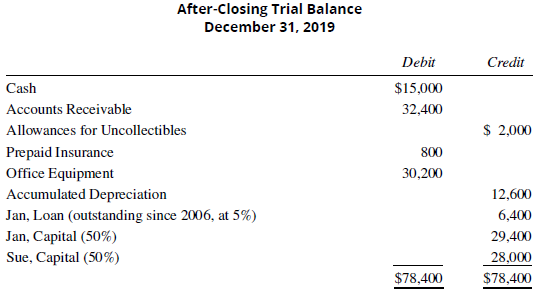

Jan and Sue have engaged successfully as partners in their law firm for a number of years. Soon after their state?s incorporation laws are changed to allow professionals to incorporate, the partners decide to organize a corporation to take over the business of the partnership. The after-closing trial balance for the partnership is as follows:

Figures shown parenthetically reflect agreed profit- and loss-sharing ratios. The partners have hired you as an accountant to adjust the recorded assets and liabilities to their market values and to close the partners? capital accounts to the new corporate capital stock. The corporation is to retain the partnership?s books, and the assets of the partnership should betaken over by the corporation in the following amounts:

Cash .......................................................... ? ?$15,000

Accounts receivable ...............................? ? ? ?32,400

Allowance for uncollectibles ................? ? ? ? ? 2,900

Prepaid insurance .................................? ? ? ? ? ? ?800

Office equipment .................................. ? ? ? ?16,000

Jan?s loan is to be transferred to her capital account in the amount of $6,600.

Required:

A. Prepare the necessary journal entries to express the agreement described.

B. Prepare the entries to record the issuance of shares to Jan and Sue, assuming the issuance of 400 shares (par value $100) of stock to Jan and Sue.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer: