On January 1, Year 4, Cyrus Inc. paid $914,000 in cash to acquire all of the ordinary

Question:

On January 1, Year 4, Cyrus Inc. paid $914,000 in cash to acquire all of the ordinary shares of Fazli Company. On that date, Fazli's retained earnings were $200,000. All of Fazli's assets and liabilities had fair values equal to carrying amounts except for equipment, which was worth $50,000 more than carrying amount and had a remaining useful life of five years.

In Year 4, Cyrus reported net income from its own operations (exclusive of any income from Fazli) of $125,000 and declared no dividends. In Year 4, Fazli reported net income of $90,000 and paid a $40,000 cash dividend. Cyrus uses the cost method to report its investment in Fazli.

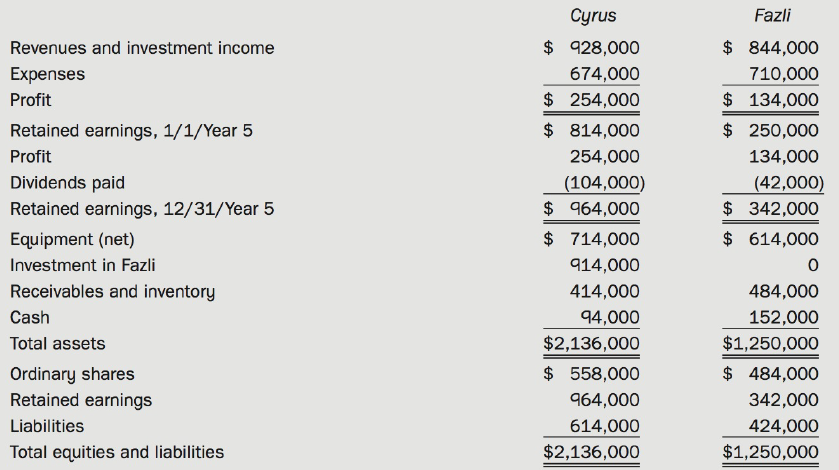

The financial statements for Cyrus and Fazli for the year ended December 31, Year 5, were as follows:

(a) Prepare a schedule to allocate and amortize the acquisition differential for Years 4 and 5.

(b) Calculate equipment and goodwill for the consolidated balance sheet at the end of Year 5.

(c) Calculate investment income from Fazli and investment in Fazli account balances for Cyrus's separate entity financial statements for Year 5, assuming Cyrus uses the

(i) Cost method

(ii) Equity method

(d) How does the parent's method of accounting for its investment affect the amount reported for expenses in its December 31, Year 5, consolidated income statement?

(e) How does the parent's method of accounting for its investment affect the amount reported for equipment in its December 31, Year 5, consolidated balance sheet?

(f) What is Cyrus's January 1, Year 5, retained earnings account balance assuming Cyrus accounts for its investment in Fazli using the

(i) Cost method?

(ii) Equity method?

(g) What is consolidated retained earnings at January 1, Year 5 assuming Cyrus accounts for its investment in Fazli using the

(i) Cost method?

(ii) Equity method?

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Consolidated Income Statement

When talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell