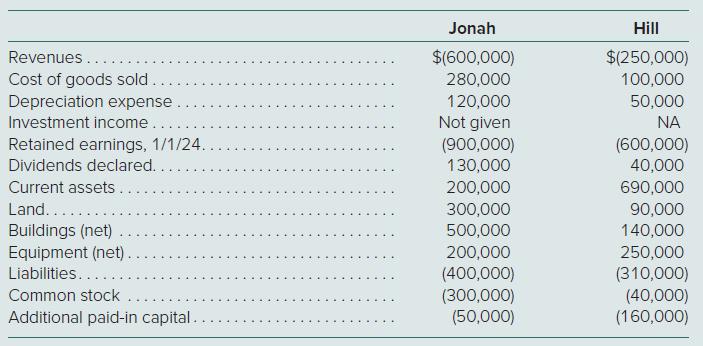

The following are selected accounts and balances for Jonah Company and Hill, Inc., as of December 31,

Question:

The following are selected accounts and balances for Jonah Company and Hill, Inc., as of December 31, 2024. Several of Jonah’s accounts have been omitted. Credit balances are indicated by parentheses. Dividends were declared and paid in the same period.

Assume that Jonah acquired Hill on January 1, 2020, by issuing 7,000 shares of common stock having a par value of $10 per share but a fair value of $100 each. On January 1, 2020, Hill’s land was undervalued by $20,000, its buildings were overvalued by $30,000, and equipment was undervalued by $60,000. The buildings had a 10-year remaining life; the equipment had a 5-year remaining life. A proprietary database with an appraised value of $100,000 was developed internally by Hill and was estimated to have a 20-year remaining useful life.

a. Determine and explain the December 31, 2024, consolidated totals for the following accounts:

b. In requirement part (a), why can the consolidated totals be determined without knowing which method the parent used to account for the subsidiary?

c. If the parent uses the equity method, what consolidation entries would be used on a 2024 worksheet?

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik