The ? goodwill ? footnote for American Oriental Bioengineering 2011 10K is shown below. When firms make

Question:

The ?goodwill? footnote for American Oriental Bioengineering 2011 10K is shown below. When firms make acquisitions, the goodwill recorded in an acquisition must be assigned to a reportable segment. See Chapter 14 for a complete discussion of segmental reporting. Thus a reportable segment (such as the manufacturing segment in the footnote below) may include several different acquisitions that have been made over time but are aggregated for disclosure purposes. It can be very difficult to track an acquisition over time if several companies are aggregated. Use the goodwill checklist to assess whether the company is disclosing all required information about goodwill according to GAAP.

Note 11: Goodwill

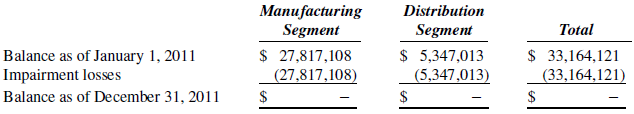

The changes in the carrying amount of goodwill for the year ended December 31, 2011, are as follows.

The manufacturing and distribution segments were tested for impairment after the annual forecasting process. Due to an increase in competition in the generic drug market in China under the health care reform, and the governments? downward pressure on prices, the operating profits and cash flows for the manufacturing segment were lower than expected in the fourth quarter of 2011. Based on that trend, the earnings forecasts for the next five years were revised. For the year ended December 31. 2011, a goodwill impairment loss of $27,817,108 and $5,347,013 were recognized in the manufacturing reporting units and distribution reporting units respectively. No impairments occurred with respect to the carrying value of goodwill in 2010 and 2009. The fair value of those reporting units was estimated using the expected present value of future cash flows expected at that time.

Required:

Part A: Goodwill Disclosures

1. Does the company provide a schedule showing the changes in the gross amount and impairment losses at the beginning and end of the year?

2. Does the company show any additional goodwill during the period? How did the firm obtain the goodwill?

3. Does the company report the amount of impairment losses recognized during the period?

4. Are there other changes in the carrying amount of goodwill? Are there any unusual or questionable issues relating to goodwill disclosures? What are they?

Part B: Goodwill Impairments

1. Does the company provide a description of the facts and circumstances leading to the impairment, such as the reason for the impairment?

2. Can you determine which acquisition is associated with the goodwill impairment?

3. For the amount of the impairment loss, which method is used to determine the fair value of the associated reporting unit: (a) quoted market prices, (b) prices of comparable businesses, and/or (c) present value or other valuation technique.

4. Is the recognized impairment loss an estimate or a finalized amount)?

A. If the impairment loss is an estimate, why is the impairment loss not finalized?

B. What is the nature and amount of any significant adjustments made to the initial estimate of the impairment loss?

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of...

Step by Step Answer: