Consider the hypothetical listing below for 10-year Treasury note futures on the Chicago Board of Trade. One

Question:

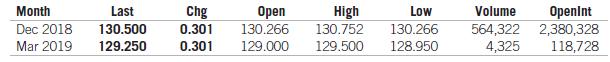

Consider the hypothetical listing below for 10-year Treasury note futures on the Chicago Board of Trade. One futures contract for Treasury notes = $100,000 face value of 10-year 6% notes.

a. If today you bought two contracts expiring in December 2018, how much would you pay?

b. What does the "OpenInt" on a futures contract mean? What is the OpenInt on the contract expiring in March 2019?

c. If you were a speculator who expected interest rates to fall, would you buy or sell these futures contracts? Briefly explain.

d. Suppose you sell the December futures contract, and one day later, the Chicago Board of Trade informs you that it has credited funds to your margin account. What happened to interest rates during that day? Briefly explain.

Face ValueFace value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Money, Banking, and the Financial System

ISBN: 978-0134524061

3rd edition

Authors: R. Glenn Hubbard, Anthony Patrick O'Brien