Use the following information on call and put options for Facebook to answer the questions. a. What

Question:

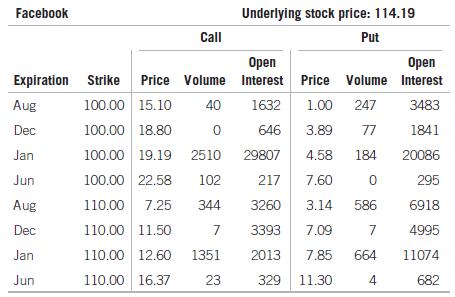

Use the following information on call and put options for Facebook to answer the questions.

a. What is the intrinsic value of the call option that expires in June and has a $100.00 strike price?

b. What is the intrinsic value of the put option that expires in January and has a $100.00 strike price?

c. Briefly explain why a call with a $110 strike price sells for less than a call with a $100 strike price (for all expiration dates), while a put with a $110 strike price sells for more than a put with a $100 strike price (for all expiration dates).

d. Suppose you buy the June call with a strike price of $110. If you exercise it when the price of Facebook is $125, what will be your profit or loss? (Remember that each options contract is for 100 shares of stock.)

e. Suppose you buy the June put with a strike price of $110 at the price listed, and the price of Facebook stock remains at $114.19. What will be your profit or loss?

Strike PriceIn finance, the strike price of an option is the fixed price at which the owner of the option can buy, or sell, the underlying security or commodity.

Step by Step Answer:

Money, Banking, and the Financial System

ISBN: 978-0134524061

3rd edition

Authors: R. Glenn Hubbard, Anthony Patrick O'Brien