As a security analyst covering the French market, youve identified the following factors and factor sensitivities for

Question:

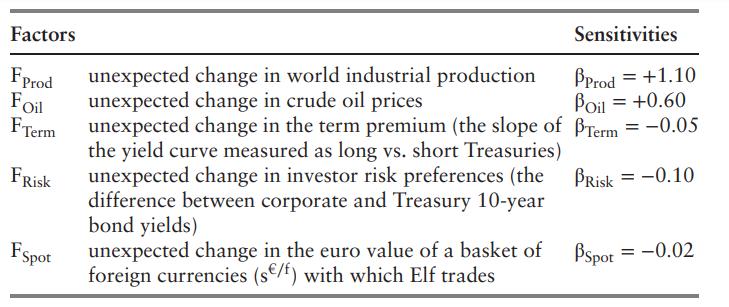

As a security analyst covering the French market, you’ve identified the following factors and factor sensitivities for Elf Acquitaine (“Elf”):

![]()

Elf’s functional currency is the euro. Factors and factor sensitivities in euros are as follows:

Elf’s expected return is α = 12 percent if all factors are equal to zero.

a. State whether Elf’s shares are likely to go up or down with an increase in world industrial production, crude oil prices, the slope of the term structure, the risk premium, or the euro.

b. Given these parameters, what is the expected return on Elf stock in a year when each factor is 10 percent higher than its expectation?

c. If Elf stock falls by 12 percent during this period, by how much does Elf overor underperform its expectation given each of the factors was 10 percent higher than its expectation during the period?

Step by Step Answer: