An investment of $10,000 in a high-risk venture has a 50-50 chance over the next year of

Question:

An investment of $10,000 in a high-risk venture has a 50-50 chance over the next year of increasing to $14,000 or decreasing to $8000. Thus the net return can be either $4000 or −$2000.

(a) Assuming a risk-neutral investor and a utility scale from 0 to 100, determine the utility of $0 net return on investment and the associated indifference probability.

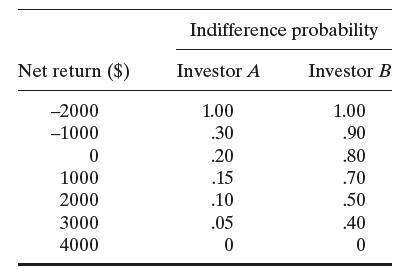

(b) Suppose that two investors A and B have exhibited the following indifference probabilities:

Graph the utility functions for investors A and B, and categorize each investor as either a risk-averse person or a risk seeker.

(c) Suppose that investor A has the chance to invest in one of two ventures. Venture I can produce a net return of $2000 with probability .4 or a net loss of $1000 with probability .6. Venture II can produce a net return of $3000 with probability .6 and no return with probability .4. Based on the utility function in (b), use the expected utility criterion to determine the venture investor A should select. What is the expected monetary value associated with the selected venture?

(d) Repeat part (c) for investor B.

Step by Step Answer: