Question: We are given a data matrix X = [x (1) , . . . , x (m) ], with x (i) R n ,

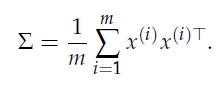

We are given a data matrix X = [x(1), . . . , x(m)], with x(i) ∈ Rn, i = 1, . . . ,m. We assume that the data is centered: x(1) + . . . + x(m) = 0. An (empirical) estimate of the covariance matrix is

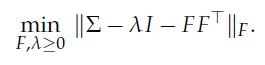

In practice, one often finds that the above estimate of the covariance matrix is noisy. One way to remove noise is to approximate the covariance matrix as ![]() , where F is a n x k matrix, containing the so-called “factor loadings,” with k

, where F is a n x k matrix, containing the so-called “factor loadings,” with k

x = F f + σe,

where x is the (random) vector of centered observations, (f , e) is a random variable with zero mean and unit covariance matrix, and σ = √λ is the standard deviation of the idiosyncratic noise component σe. The interpretation of the stochastic model is that the observations are a combination of a small number k of factors, plus a noise part that affects each dimension independently. To fit F, λ to data, we seek to solve

1. Assume l is known and less than λk (the k-th largest eigenvalue of the empirical covariance matrix ∑). Express an optimal F as a function of λ, which we denote F(λ). In other words: you are asked to solve for F, with fixed λ.

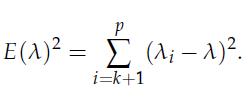

2. Show that the error ![]() the matrix you found in the previous part, can be written as

the matrix you found in the previous part, can be written as

Find a closed-form expression for the optimal l that minimizes the error, and summarize your solution to the estimation problem (13.35).

3. Assume that we wish to estimate the risk (as measured by variance) involved in a specific direction in data space. Recall from Example 4.2 that, given a unit-norm n-vector w, the variance along direction ω is ωT ∑ω. Show that the rank-k approximation to S results in an under-estimate of the directional risk, as compared with using ∑. How about the approximation based on the factor model above? Discuss.

M 1 m [x(i) x(i) T m i=1

Step by Step Solution

3.33 Rating (162 Votes )

There are 3 Steps involved in it

1 Since k we see that the above is positive semidefinite It can be written as FF T with 2 Fro... View full answer

Get step-by-step solutions from verified subject matter experts