Attica Group, a transportation company, has fixed operating costs of 250,000 and variable costs of 60% of

Question:

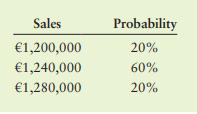

Attica Group, a transportation company, has fixed operating costs of €250,000 and variable costs of 60% of sales. It has made the following sales estimates, with the probabilities noted.

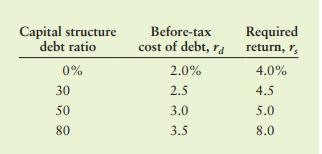

The company wants to analyze four different capital structures: 0%, 30%, 50%, and 80% debt ratios. The total assets are assumed constant at €4,000,000. Its common stock has a book value of €25 per share, and the corporate tax rate in Greece is 29%. The following additional data have been gathered for analyzing the capital structures under consideration.

a. Calculate the level of EBIT associated with the three levels of sales.

b. Calculate the amount of debt, the amount of equity, and the number of shares of common stock outstanding for each of the four capital structures.

c. Calculate the annual interest rate on the debt under each of the four capital structures.

d. Calculate the EPS associated with each of the three levels of EBIT calculated in part a for each of the capital structures being considered.

e. Calculate (1) the expected EPS, (2) the standard deviation of EPS, and (3) the coefficient of variation of EPS for each of the capital structures, using your findings in part d.

f. Plot the expected EPS and the coefficient of variation of EPS against the capital structures (x-axis) on separate sets of axes, and comment on the return and risk relative to capital structure.

g. Using the EBIT-EPS data developed in part d, plot the 0%, and the 30% capital structures on the same set of EBIT-EPS axes, and discuss the ranges over which each is preferred. What is the major problem with the use of this approach?

h. Using the valuation model and your findings in part e, estimate the share value of each of the capital structures.

i. Compare and contrast your findings in parts f and h. Which structure is preferred if the goal is to maximize EPS? Which structure is preferred if the goal is to maximize share price? Which capital structure do you recommend? Explain.

Step by Step Answer:

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart