Correlation, risk, and return Nikki Williams wishes to evaluate the risk and return behaviors associated with various

Question:

Correlation, risk, and return Nikki Williams wishes to evaluate the risk and return behaviors associated with various combinations of assets X and Y under three assumed degrees of correlation: perfectly positive, uncorrelated, and perfectly negative.

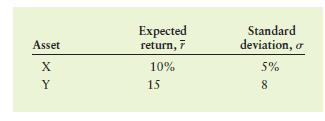

The expected returns and standard deviations calculated for each of the assets are shown in the following table.

a. If the returns of assets X and Y are perfectly positively correlated (correlation coefficient = +1), describe the range of (1) expected return and (2) risk associated with all possible portfolio combinations.

b. If the returns of assets X and Y are uncorrelated (correlation coefficient = 0), describe the approximate range of (1) expected return and (2) risk associated with all possible portfolio combinations.

c. If the returns of assets X and Y are perfectly negatively correlated (correlation coefficient = -1), describe the range of (1) expected return and (2) risk associated with all possible portfolio combinations.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart