Manchester Hospitality owns a range of restaurants in Yorkshire, England. It wishes to determine the value of

Question:

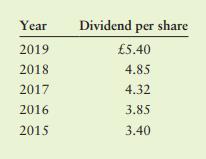

Manchester Hospitality owns a range of restaurants in Yorkshire, England. It wishes to determine the value of McDermot Limited, a firm that it is considering acquiring for cash. Manchester Hospitality wishes to determine the applicable discount rate to use as an input to the constant growth valuation model. McDermot’s stock is not publicly traded. After studying the required returns of firms similar to McDermot that are publicly traded, Manchester Hospitality believes that an appropriate risk premium on McDermot stock is about 10%.The risk-free rate of return is currently 4%. McDermot’s dividend per share for each of the past 5 years is shown in the following table.

a. Given that McDermot is expected to pay a dividend of £5.90 next year, determine the maximum cash price that Manchester Hospitality should pay for each share of McDermot.

b. How will the following changes affect the resulting value of McDermot? (1) A decrease in its dividend growth by 2% from that exhibited over 2015–2019 period. (2) An increase in its risk premium to 12%.

Step by Step Answer:

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart