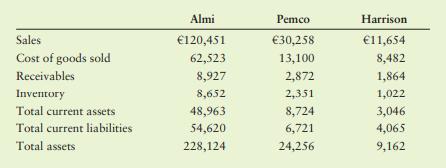

The table below shows key financial data for three supermarket chains that compete in the grocery retail

Question:

The table below shows key financial data for three supermarket chains that compete in the grocery retail industry: Almi, Pemco, and Harrison. All euro values are in thousands.

a. Calculate each of the following ratios for all three companies: current ratio, quick ratio, inventory turnover, average collection period, and total asset turnover.

b. Which company has the best liquidity position?

c. Would you say that the three companies are managing their debtors on a comparative basis? Which one has the best performance in terms of collecting its receivables? Which is the worst?

d. Which company has the most rapid inventory turnover? Which has the lowest asset turnover? Compare your results and explain why a company may have the best inventory turnover but the worst asset turnover.

Step by Step Answer:

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart