Question: Alpine Ltd. operates a machine shop. It does custom machining, welding, fabricating, and other metalwork for a large number of customers and also manufactures a

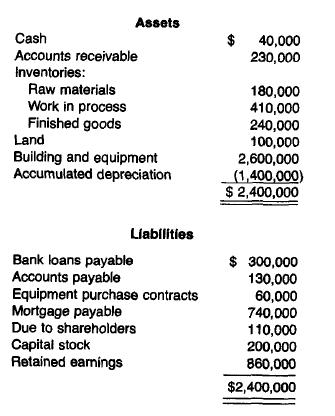

Alpine Ltd. operates a machine shop. It does custom machining, welding, fabricating, and other metalwork for a large number of customers and also manufactures a line of metal utensils for camping and similar outdoor activities. Its customers for the custom work (which is about 80 percent of its business) are other businesses of many kinds; its customers for the utensils are wholesalers and retail chains. As at the fiscal year ended December 31, 19X9, the company's unaudited balance sheet showed:

The company had been growing slowly until early 19X9, when the president, treasurer, and production manager retired, turning the management over to a group of younger managers, all of whom became minor shareholders. The new group embarked upon an ambitious expansion program. In July 19X9, A. Fernand, CPA, was appointed auditor. On his short first visit to the company's offices, Fernand has determined that

1. The accounting and office staff of three clerks and a typist are supervised by the controller (one of the group of new shareholders).

2. The preparation of income tax returns, statistical reports to governments, and other such documents had been done by the previous auditor, and the controller expected that Fernand would also prepare them.

3. Perpetual inventory records are maintained for raw materials, finished utensils manufactured for stock, and (on a job order basis) custom work in process. Memorandum records are maintained on the shop floor for utensils in process; these records are not tied into the general ledger.

4. Custom work reaches its peak activity in the summer and is at a low point of activity in the autumn and winter. Therefore, most of the annual production of utensils is done during the winter. Finished utensils are sold in the spring and early summer.

a. What factors would control the timing of Fernand's audit work on Alpine Ltd.?

b. Assume the following:

1. The Company wishes to have its audited financial statements as at December 31, 19X9, ready by January 20, 19X0.

2. Fernand has evaluated the company's control risk and found it to be low for accounts receivable and those inventories having perpetual records but high elsewhere.

3. Fernand has done no audit work other than to understand the internal control structure.

4. It is mid-September 19X9. Outline in general terms the work Fernand could do prior to December 31, 19X9, to enable him to complete his work by January 20, 19X0. Specify the amount that Fernand would regard as material to the financial statements and explain how this amount would be used in planning the audit. Also, identify those factors that would affect Fernand's assessment of audit risk and explain their influence on the audit plan.

Assets Cash 40,000 Accounts receivable 230,000 Inventories: Raw materials 180,000 Work in process Finished goods Land Building and equipment Accumulated depreciation 410,000 240,000 100,000 2,600,000 (1,400,000) $2,400,000 Liabilities Bank loans payable $ 300,000 Accounts payable 130,000 Equipment purchase contracts Mortgage payable Due to shareholders Capital stock Retained earnings 60,000 740,000 110,000 200,000 860,000 $2,400,000

Step by Step Solution

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts