Question: 172 You have been asked to use the expected-value model to assess the risk in developing a new product. Each strategy requires a different sum

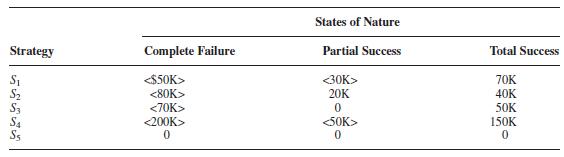

17–2 You have been asked to use the expected-value model to assess the risk in developing a new product. Each strategy requires a different sum of money to be invested and produces a different profit payoff as shown below:

8. A More Constructive Test Approach Is Key to Better Weapon System Outcomes, Best Practice Series, GAO/NSIAD-00-199, Government Accounting Office, July 2000, pp. 23–25.

Assume that the probabilities for each state are 30 percent, 50 percent, and 20 percent, respectively.

a. Using the concept of expected value, what risk (i.e., strategy) should be taken?

b. If the project manager adopts a go-for-broke attitude, what strategy should be selected?

c. If the project manager is a pessimist and does not have the option of strategy S5, what risk would be taken?

d. Would your answer to part c change if strategy S5 were an option?

Strategy 55555 States of Nature Partial Success Complete Failure 20K 0 0 0 Total Success 70K 40K 50K 150K 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts