Question

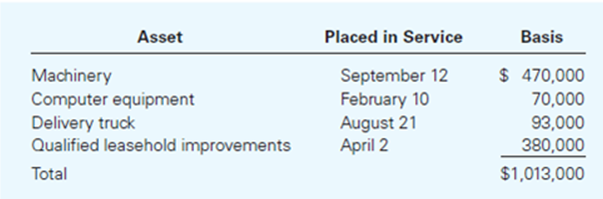

Assume that ACW Corporation has 2016 taxable income of $1,000,000 before the ?179 expense and acquired the following assets during 2016 (assume no bonus depreciation).

Assume that ACW Corporation has 2016 taxable income of $1,000,000 before the ?179 expense and acquired the following assets during 2016 (assume no bonus depreciation).

(a) What is the maximum amount of ?179 expense ACW may deduct for 2016?

(b) What is the maximum total depreciation expense that ACW may deduct in 2016 on the assets it placed in service in 2016?

Asset Machinery Computer equipment Delivery truck Qualified leasehold improvements Total Placed in Service September 12 February 10 August 21 April 2 Basis $ 470,000 70,000 93,000 380,000 $1,013,000

Step by Step Solution

3.36 Rating (131 Votes )

There are 3 Steps involved in it

Step: 1

Section 179 expenses It is a special rule to recover the cost of tangible personal property Apart from depreciation expenses Section 179 allows to ded...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

609ada9e45a8a_31054.pdf

180 KBs PDF File

609ada9e45a8a_31054.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started