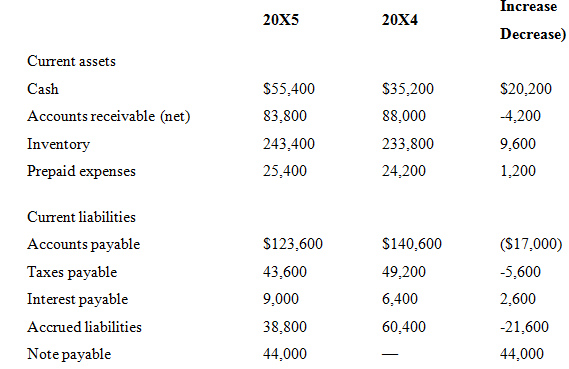

Question: Cash flow information: Direct and indirect methods The comparative year-end balance sheets of Sign Graphics, Inc., revealed the following activity in the company's current accounts:

Cash flow information: Direct and indirect methods

The comparative year-end balance sheets of Sign Graphics, Inc., revealed the following activity in the company's current accounts:

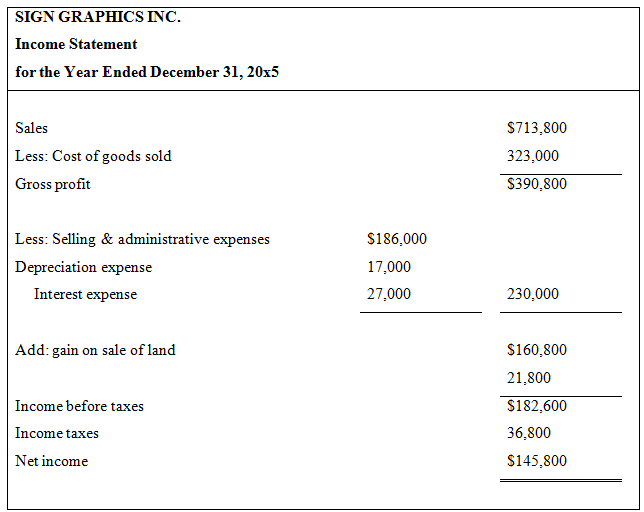

The accounts payable were for the purchase of merchandise. Prepaid expenses and accrued liabilities relate to the firm's selling and administrative expenses. The company's condensed income statement follows.

Current assets Cash Accounts receivable (net) Inventory Prepaid expenses Current liabilities Accounts payable Taxes payable Interest payable Accrued liabilities Note payable 20X5 $55,400 83,800 243,400 25,400 $123,600 43,600 9,000 38,800 44,000 20X4 $35,200 88,000 233,800 24,200 $140,600 49,200 6,400 60,400 Increase Decrease) $20,200 -4,200 9,600 1,200 ($17,000) -5,600 2,600 -21,600 44,000 SIGN GRAPHICS INC. Income Statement for the Year Ended December 31, 20x5 Sales Less: Cost of goods sold Gross profit Less: Selling & administrative expenses Depreciation expense Interest expense Add: gain on sale of land Income before taxes Income taxes Net income $186,000 17,000 27,000 $713,800 323,000 $390,800 230,000 $160,800 21,800 $182,600 36,800 $145,800

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

To analyze the cash flow information using both the direct and indirect methods well go through the steps to prepare a cash flow statement The key foc... View full answer

Get step-by-step solutions from verified subject matter experts