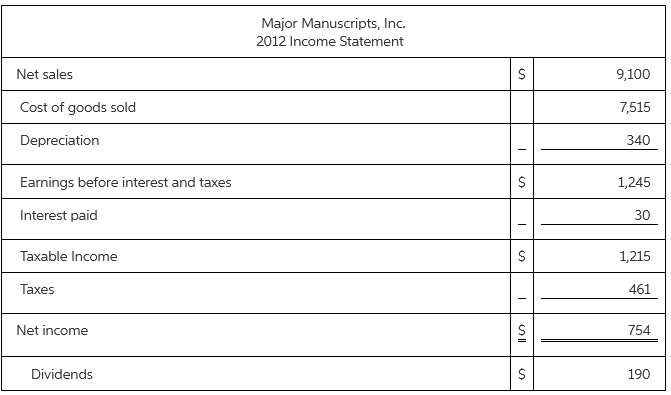

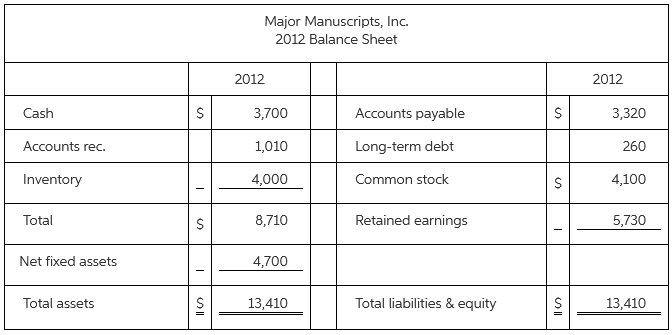

Major Manuscripts, Inc., is currently operating at maximum capacity. All costs, assets, and current liabilities vary directly

Fantastic news! We've Found the answer you've been seeking!

Question:

Major Manuscripts, Inc., is currently operating at maximum capacity. All costs, assets, and current liabilities vary directly with sales. The tax rate and the dividend payout ratio will remain constant. How much additional debt is required if no new equity is raised and sales are projected to increase by 10 percent?

$129

$389

$620

$649

$70

Related Book For

Managerial Accounting A Focus on Ethical Decision Making

ISBN: 978-0324663853

5th edition

Authors: Steve Jackson, Roby Sawyers, Greg Jenkins

Posted Date: