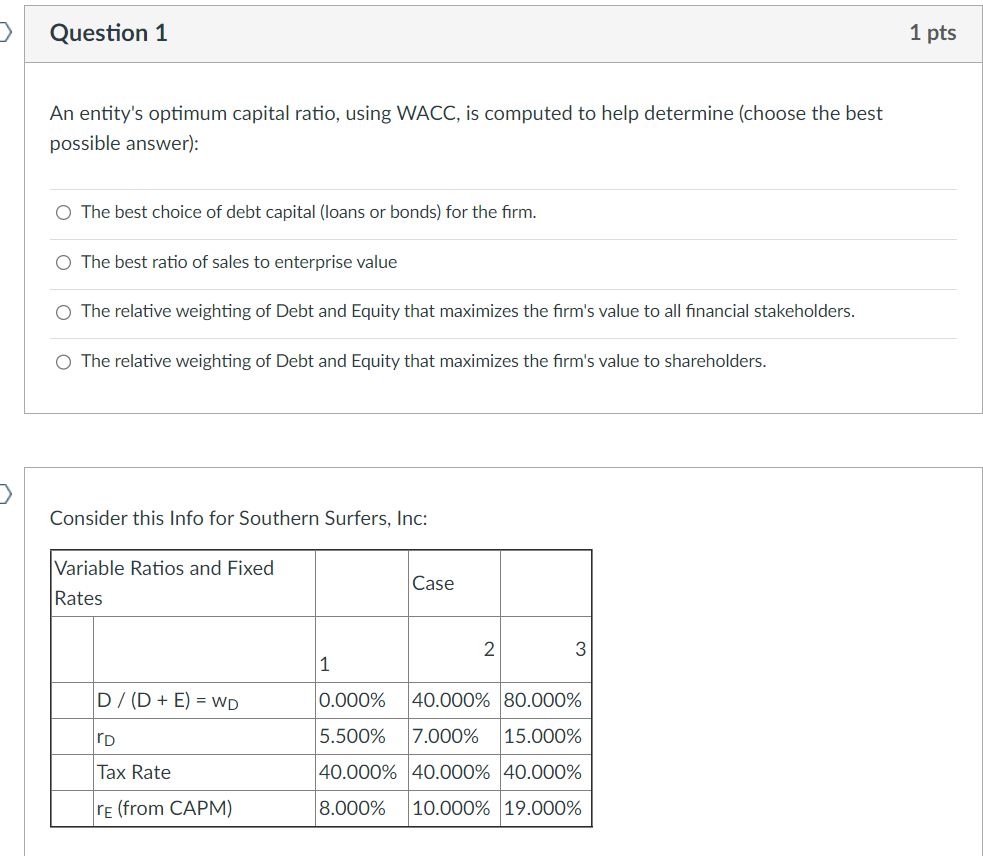

Question: Question 1 1 pts An entity's optimum capital ratio, using WACC, is computed to help determine (choose the best possible answer): (O The best choice

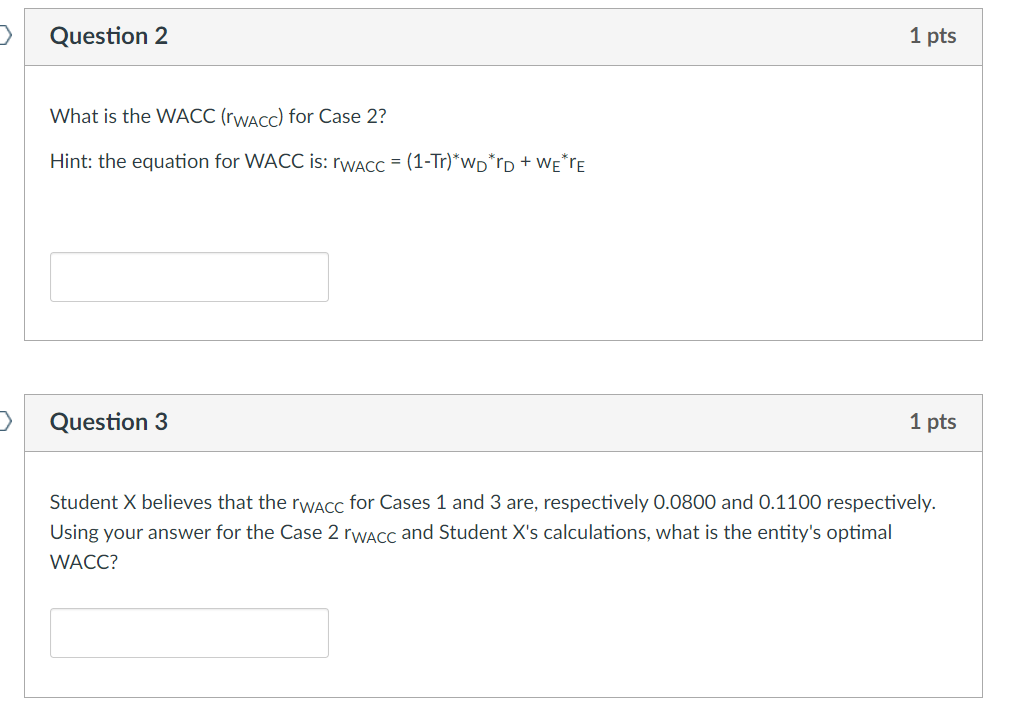

Question 1 1 pts An entity's optimum capital ratio, using WACC, is computed to help determine (choose the best possible answer): (O The best choice of debt capital (loans or bonds) for the firm. (O The best ratio of sales to enterprise value (O The relative weighting of Debt and Equity that maximizes the firm's value to all financial stakeholders. (O The relative weighting of Debt and Equity that maximizes the firm's value to shareholders. Consider this Info for Southern Surfers, Inc: Variable Ratios and Fixed Rates D/(D+E)=wp 0.000% |40.000% |80.000% o 5.500% 15.000% Tax Rate 40.000% |40.000% |40.000% re (from CAPM) 10.000% |19.000% Question 2 1 pts What is the WACC (rwAcc) for Case 2? Hint: the equation for WACC is: TWAcc = (1-Tr)*WD*rD + WE*rE Question 3 1 pts Student X believes that the wAcc for Cases 1 and 3 are, respectively 0.0800 and 0.1100 respectively. Using your answer for the Case 2 rwAcc and Student X's calculations, what is the entity's optimal WACC?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts