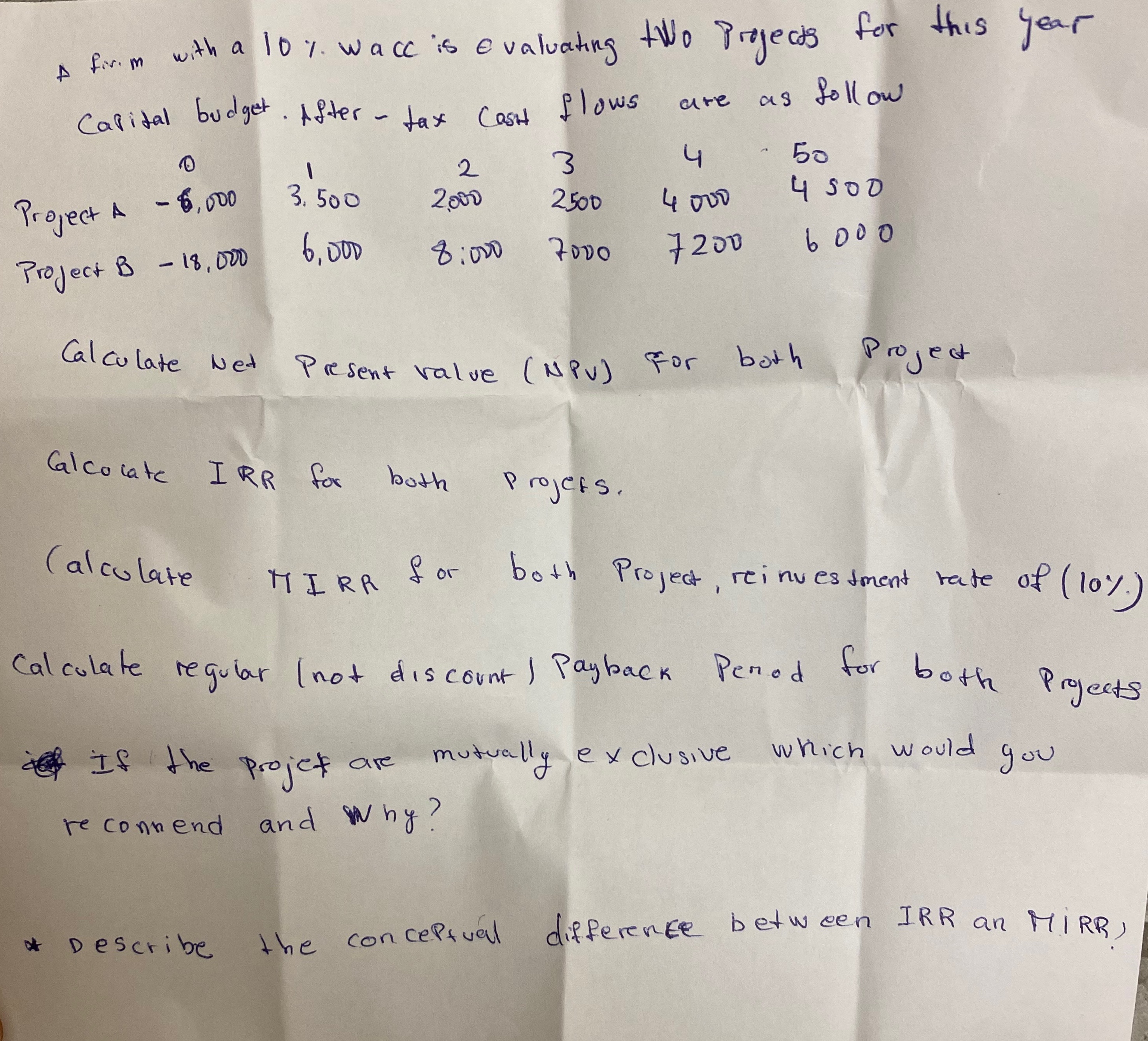

Question: A firm with a 10% wace is evaluating two projects for this year Callital budget . After- tax cash flows are as follow 2 3

A firm with a 10% wace is evaluating two projects for this year Callital budget . After- tax cash flows are as follow 2 3 4 50 Project A - 8,000 3. 500 2000 2500 4 0ND 4 500 Project B - 18,000 6, 00D 8: 080 7200 6 00 0 Calculate Net Present value ( NPV) For both Project Calculate IRR for both projets. ( alculate "MIRR for both Project, reinvestment rate of ( 10%. ) Calculate regular ( not discount ) Payback Pened for both Projects If the project are mutually exclusive which would you recommend and Why? * Describe the conceptual difference between IRR an MIRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts