Question: 1. Company A has a beta of 1.6, while Company B's beta is 0.4. The required return on the stock market is 14.00%, and the

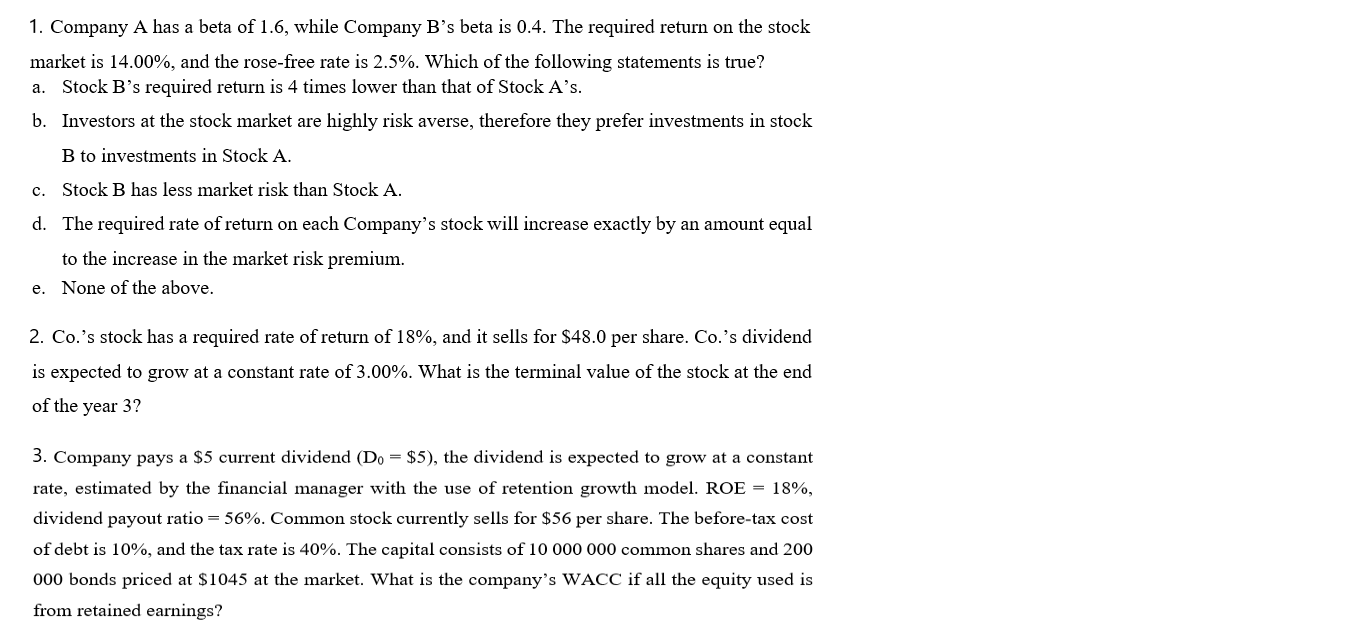

1. Company A has a beta of 1.6, while Company B's beta is 0.4. The required return on the stock market is 14.00%, and the rose-free rate is 2.5%. Which of the following statements is true? a. Stock B's required retum is 4 times lower than that of Stock A's. b. Investors at the stock market are highly risk averse, therefore they prefer investments in stock B to investments in Stock A. c. Stock B has less market risk than Stock A. d. The required rate of return on each Company's stock will increase exactly by an amount equal to the increase in the market risk premium. e. None of the above. 2. Co.'s stock has a required rate of return of 18%, and it sells for $48.0 per share. Co.'s dividend is expected to grow at a constant rate of 3.00%. What is the terminal value of the stock at the end of the year 3? 3. Company pays a 35 current dividend (D9 = $5). the dividend is expected to grow at a constant rate. estimated by the nancial manager with the use of retention growth model. ROE = 18%. dividend payout ratio = 56%. Common stock currently sells for $56 per share. The before-tax cost ofdebt is 10%, and the tax rate is 40%. The capital consists of 10 000 000 common shares and 200 000 bonds priced at $1045 at the market. What is the company's WACC if all the equity used is from retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts