Question: Dog Up! Franks is looking at a new sausage system with an installed cost of $385,000. This cost will be depreciated straight-line to zero over

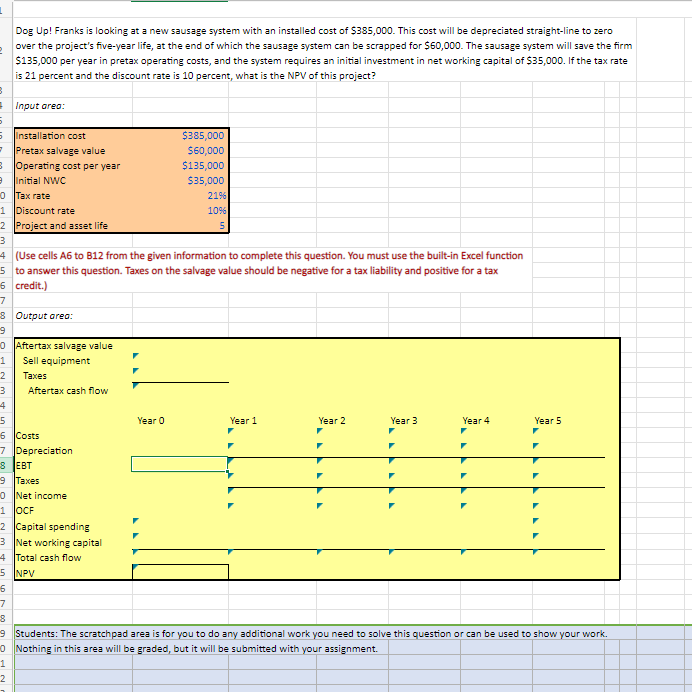

Dog Up! Franks is looking at a new sausage system with an installed cost of $385,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sausage system can be scrapped for $60,000. The sausage system will save the firm $135,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $35,000. If the tax rate is 21 percent and the discount rate is 10 percent, what is the NPV of this project? Input oreo: nstallation cost $385,000 Pretax salvage value $60,000 Operating cost per year $135,000 nitiel NWC $35,000 Tax rate 21% Discount rate 10% Project and asset life (Use cells A6 to 812 from the given information to complete this question. You must use the built-in Excel function to answer this question. Taxes on the salvage value should be negative for a tax liability and positive for a tax credit.) Output area: Aftertax salvage value Sell equipment Taxes Aftertax cash flow Year O Year 1 Year 2 Year 3 Year 4 Year 5 Costs F Depreciation EBT F F F Taxes Net income OCF Capital spending Net working capital Total cash flow NPV Students: The scratchpad area is for you to do any additional work you need to solve this question or can be used to show your work. Nothing in this area will be graded, but it will be submitted with your assignment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts