Question: Your portfolio consists of 2 shares of Stock XYZ and 2 short call options on XYZ with a strike price 600 and 1 long

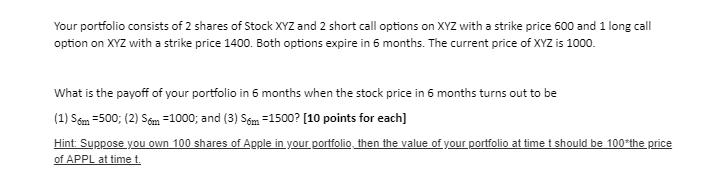

Your portfolio consists of 2 shares of Stock XYZ and 2 short call options on XYZ with a strike price 600 and 1 long call option on XYZ with a strike price 1400. Both options expire in 6 months. The current price of XYZ is 1000. What is the payoff of your portfolio in 6 months when the stock price in 6 months turns out to be (1) S6m =500; (2) S6m -1000; and (3) Som=1500? [10 points for each] Hint: Suppose you own 100 shares of Apple in your portfolio, then the value of your portfolio at time t should be 100*the price of APPL at time t.

Step by Step Solution

3.33 Rating (144 Votes )

There are 3 Steps involved in it

To calculate the payoff of your portfolio in 6 months for each of the three scenarios you need to co... View full answer

Get step-by-step solutions from verified subject matter experts