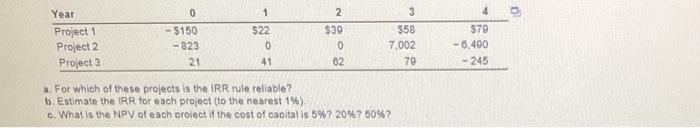

Question: 0 1 3 0 Year Project 1 Project 2 Project 3 -$150 -823 21 $22 0 2 $30 0 82 558 7,002 70 4 $70

0 1 3 0 Year Project 1 Project 2 Project 3 -$150 -823 21 $22 0 2 $30 0 82 558 7,002 70 4 $70 -0,400 -245 41 a. For which of these projects is the IRR rule reliable? b. Estimate the IRR for each project to the nearest 1%). o. What is the NPV of each project if the cost of capital is 5%? 20%? 60%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts