Question: (0 An investor has the utility function Ulw)--exp --exp(- (H) Determine whether the investor exhibits increasing, constant or decreasing absolute and relative risk aversion.

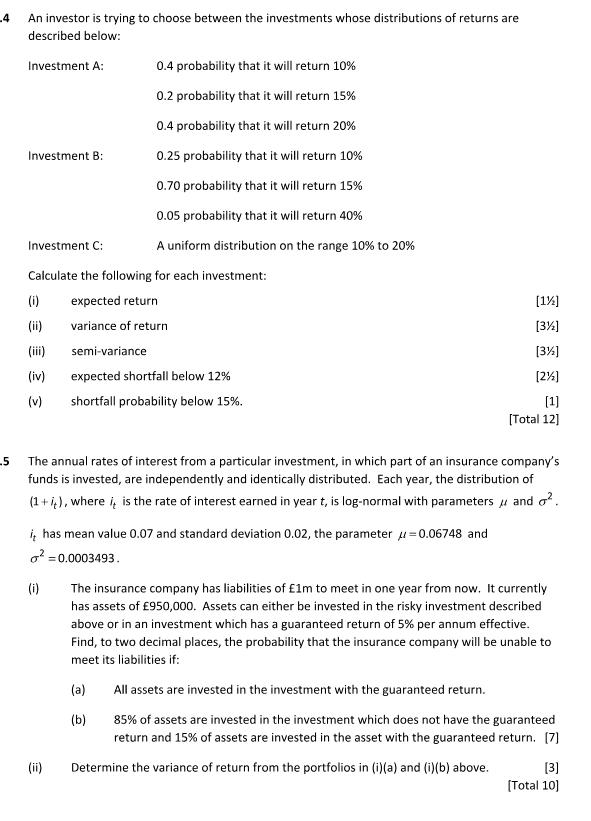

(0 An investor has the utility function Ulw)--exp --exp(- (H) Determine whether the investor exhibits increasing, constant or decreasing absolute and relative risk aversion. The investor has an initial wealth of 1,000 and is offered a gamble with a payoff described by a random variable: +100 with probability 0.5 -50 with probability 0.5 Find the investor's certainty equivalent of this gamble. 3 Two assets are available to investors. Asset B is a risk-free investment that returns 1%, and the return on Asset A is given by: X= W 100 (a) -1% 3% Explain why Asset B must be second-order stochastically dominant over Asset A in terms of investors and utility functions. (b) probability 0.5 probability 0.5 Verify numerically the second-order stochastic dominance expressed in part (1). What can be said about dominance if Asset A offers instead a return of: -1% probability 0.5 RA- 4% probability 0.5 (-1% probability 0.5 1% probability 0.5 Can an asset that allows the possibility of a return less than 1% ever dominate Asset B? R- -4 5 An investor is trying to choose between the investments whose distributions of returns are described below: Investment A: Investment B: Investment C: Calculate the following for each investment: (i) expected return variance of return semi-variance expected shortfall below 12% shortfall probability below 15%. (iii) (iv) (v) 0.4 probability that it will return 10% 0.2 probability that it will return 15% 0.4 probability that it will return 20% 0.25 probability that it will return 10% 0.70 probability that it will return 15% 0.05 probability that it will return 40% A uniform distribution on the range 10% to 20% The annual rates of interest from a particular investment, in which part of an insurance company's funds is invested, are independently and identically distributed. Each year, the distribution of (1+i), where it is the rate of interest earned in year t, is log-normal with parameters and o. it has mean value 0.07 and standard deviation 0.02, the parameter = 0.06748 and o = 0.0003493. (i) (ii) [1] [31] [31] [21] [1] [Total 12] (a) (b) The insurance company has liabilities of 1m to meet in one year from now. It currently has assets of 950,000. Assets can either be invested in the risky investment described above or in an investment which has a guaranteed return of 5% per annum effective. Find, to two decimal places, the probability that the insurance company will be unable to meet its liabilities if: All assets are invested in the investment with the guaranteed return. 85% of assets are invested in the investment which does not have the guaranteed return and 15% of assets are invested in the asset with the guaranteed return. [7] Determine the variance of return from the portfolios in (i)(a) and (i)(b) above. [3] [Total 10]

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Here are the stepbystep workings i The investor has a utility function Uw e100w This utility functio... View full answer

Get step-by-step solutions from verified subject matter experts