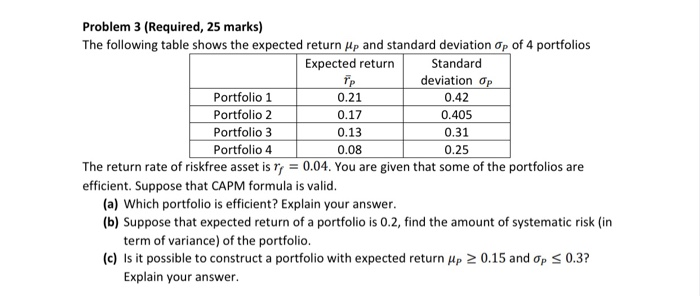

Question: 0.17 0.405 Problem 3 (Required, 25 marks) The following table shows the expected return Hp and standard deviation Op of 4 portfolios Expected return Standard

0.17 0.405 Problem 3 (Required, 25 marks) The following table shows the expected return Hp and standard deviation Op of 4 portfolios Expected return Standard deviation Op Portfolio 1 0.21 0.42 Portfolio 2 Portfolio 3 0.13 0.31 Portfolio 4 0.08 0.25 The return rate of riskfree asset is r; = 0.04. You are given that some of the portfolios are efficient. Suppose that CAPM formula is valid. (a) Which portfolio is efficient? Explain your answer. (b) Suppose that expected return of a portfolio is 0.2, find the amount of systematic risk (in term of variance) of the portfolio. (c) Is it possible to construct a portfolio with expected return up > 0.15 and op

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts