Question: 0/2 points 13. Let the present value from production be equal to V = 100, and this value can move either up or down in

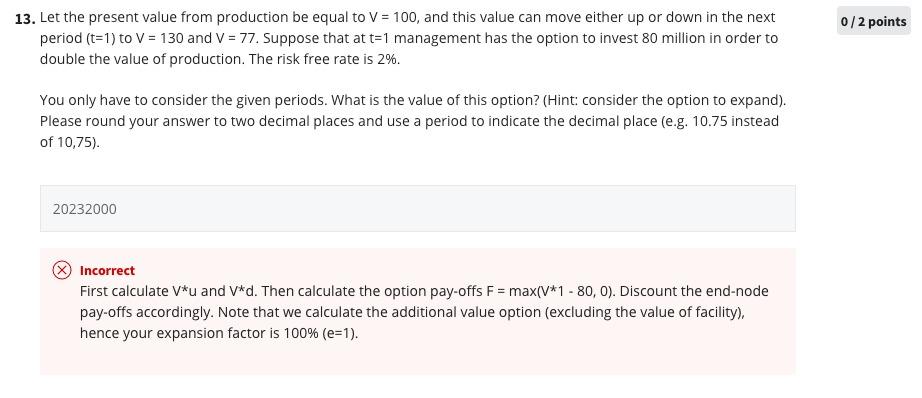

0/2 points 13. Let the present value from production be equal to V = 100, and this value can move either up or down in the next period (t=1) to V = 130 and V = 77. Suppose that at t=1 management has the option to invest 80 million in order to double the value of production. The risk free rate is 2%. You only have to consider the given periods. What is the value of this option? (Hint: consider the option to expand). Please round your answer to two decimal places and use a period to indicate the decimal place (e.g. 10.75 instead of 10,75). 20232000 Incorrect First calculate V*u and V*d. Then calculate the option pay-offs F= max(v*1 - 80,0). Discount the end-node pay-offs accordingly. Note that we calculate the additional value option (excluding the value of facility), hence your expansion factor is 100% (e=1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts