Question: 0/2 points 15. Let the present value from production be equal to V = 100, and this value can move either up (with factor u

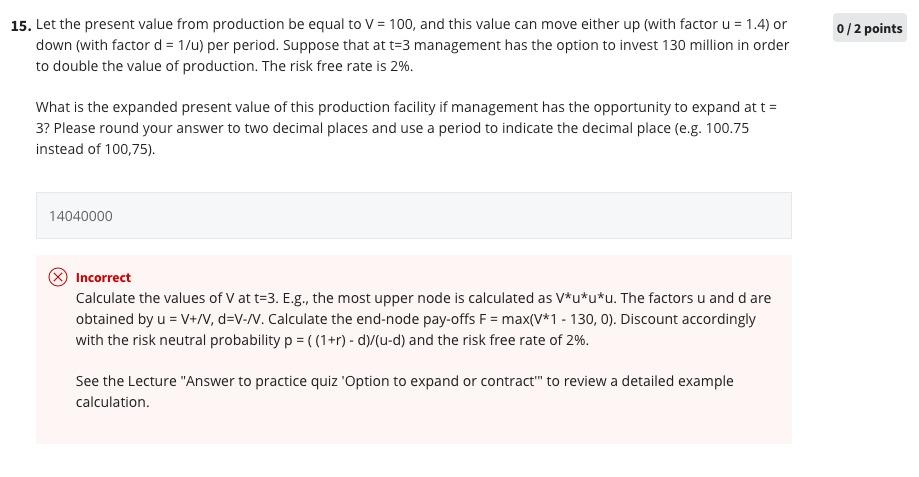

0/2 points 15. Let the present value from production be equal to V = 100, and this value can move either up (with factor u = 1.4) or down (with factor d = 1/u) per period. Suppose that at t=3 management has the option to invest 130 million in order to double the value of production. The risk free rate is 2%. What is the expanded present value of this production facility if management has the opportunity to expand atta 3? Please round your answer to two decimal places and use a period to indicate the decimal place (e.g. 100.75 instead of 100,75). 14040000 Incorrect Calculate the values of V at t=3. E.g., the most upper node is calculated as V*u*u*u. The factors u and d are obtained by u = V+/V, d=V-N. Calculate the end-node pay-offs F = max(V*1 - 130,0). Discount accordingly with the risk neutral probability p = ((1+r) - d)/(u-d) and the risk free rate of 2%. See the Lecture "Answer to practice quiz 'Option to expand or contract' to review a detailed example calculation. 0/2 points 15. Let the present value from production be equal to V = 100, and this value can move either up (with factor u = 1.4) or down (with factor d = 1/u) per period. Suppose that at t=3 management has the option to invest 130 million in order to double the value of production. The risk free rate is 2%. What is the expanded present value of this production facility if management has the opportunity to expand atta 3? Please round your answer to two decimal places and use a period to indicate the decimal place (e.g. 100.75 instead of 100,75). 14040000 Incorrect Calculate the values of V at t=3. E.g., the most upper node is calculated as V*u*u*u. The factors u and d are obtained by u = V+/V, d=V-N. Calculate the end-node pay-offs F = max(V*1 - 130,0). Discount accordingly with the risk neutral probability p = ((1+r) - d)/(u-d) and the risk free rate of 2%. See the Lecture "Answer to practice quiz 'Option to expand or contract' to review a detailed example calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts