Question: 04:57 dryden problem Chapter 8 locked Chapter 8 Problem (50-60 points of Module 8) Your problem for this week is to complete the following budget

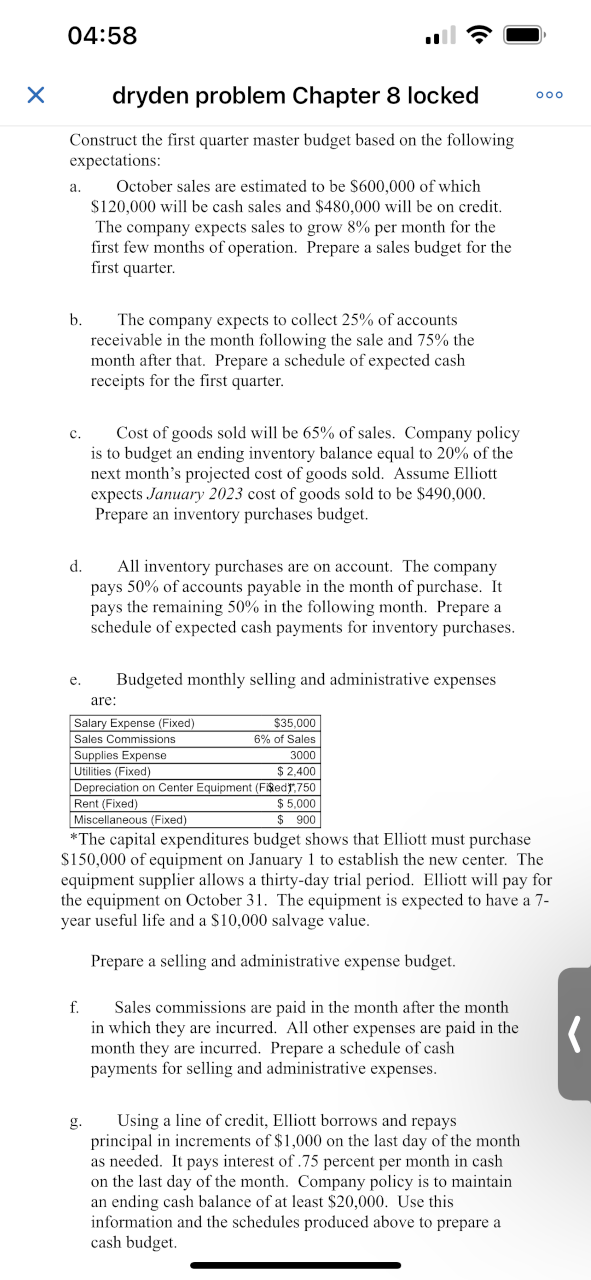

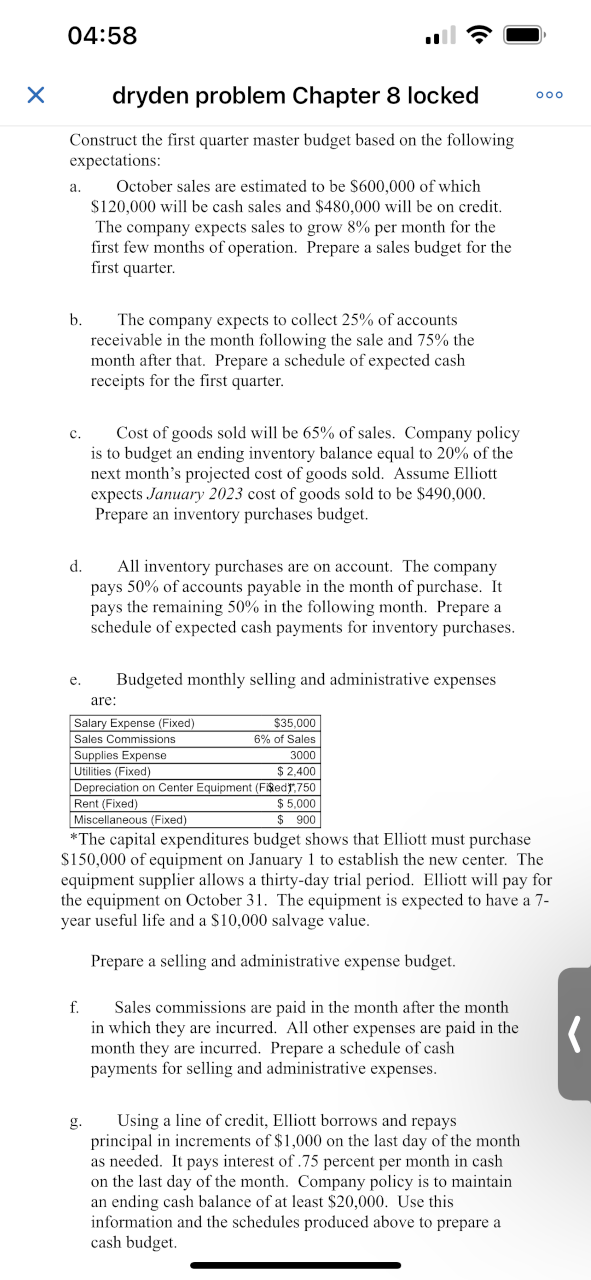

04:57 dryden problem Chapter 8 locked Chapter 8 Problem (50-60 points of Module 8) Your problem for this week is to complete the following budget for Dryden Industries. A couple of formatting tips: Please pay attention to aligning your numbers. The first and last line of each budget section should have a "$": Use the following rounding convention for decimals: 5 or less should be rounded down to the whole dollar, and above .5 should be rounded up to the higher dollar. You should have Quarter total for every line in the Sales Budget and the Purchases Budget. For the S&A Budget, only the bottom lines (Total S&A before interest and Total Payments for S&A) need to have quarter totals. For the Cash Budget, please provide quarter amounts for beginning cash, total cash available, total cash payments, surplus/shortage, net financing activities and ending cash balance. Please do NOT hand in a hand-written submission. Adapt the Elliott Budget for the Dryden Budget using the word doc on D2L. If you want extra credit, also submit the budget using Excel and use cell reference and formulas tools. This problem is worth 50 points and is due 4/12 at 11:59 (a one day extention). If you also use Excel, you can receive up to 10 additional bonus points, depending on how much you use Excel tools. Please place your submissions in the Assignments folder on D2L. Remember to use the file naming convention for this course. Remember to read the problem carefully....it is very similar to Elliott but not an exact copy. Everyone should create their own budget. Copying someone else's budget would be considered a violation of the Honor Code, resulting in a report to the Office of Student Integrity and a zero on the assignment. Dryden Industries Budgeting Problem s Dryden Industries, a wholesale company, is considering whether to open a new distribution center. The center would open October 1, 2022. To make the decision, the planning committee requires a master budget for the center's first quarter of operation (October, November and December of 2022). Required Construct the first quarter master budget based on the following expectations: October sales are estimated to be $600,000 of which $120,000 will be cash sales and $480.000 will be on credit. The company expects sales to grow 80% per month for the a. 04:58 dryden problem Chapter 8 locked a Construct the first quarter master budget based on the following expectations: October sales are estimated to be $600,000 of which $120,000 will be cash sales and $480,000 will be on credit. The company expects sales to grow 8% per month for the first few months of operation. Prepare a sales budget for the first quarter. b. The company expects to collect 25% of accounts receivable in the month following the sale and 75% the month after that. Prepare a schedule of expected cash receipts for the first quarter. c. Cost of goods sold will be 65% of sales. Company policy is to budget an ending inventory balance equal to 20% of the next month's projected cost of goods sold. Assume Elliott expects January 2023 cost of goods sold to be $490,000. Prepare an inventory purchases budget. d. All inventory purchases are on account. The company pays 50% of accounts payable in the month of purchase. It pays the remaining 50% in the following month. Prepare a schedule of expected cash payments for inventory purchases. e. Budgeted monthly selling and administrative expenses are: Salary Expense (Fixed) $35.000 Sales Commissions 6% of Sales Supplies Expense 3000 Utilities (Fixed) $ 2,400 Depreciation on Center Equipment (Fied1,750 Rent (Fixed) $5.000 Miscellaneous (Fixed) $ 900 *The capital expenditures budget shows that Elliott must purchase $150,000 of equipment on January 1 to establish the new center. The equipment supplier allows a thirty-day trial period. Elliott will pay for the equipment on October 31. The equipment is expected to have a 7- year useful life and a $10,000 salvage value. Prepare a selling and administrative expense budget. f. Sales commissions are paid in the month after the month in which they are incurred. All other expenses are paid in the month they are incurred. Prepare a schedule of cash payments for selling and administrative expenses. s g. Using a line of credit, Elliott borrows and repays principal in increments of $1,000 on the last day of the month as needed. It pays interest of 75 percent per month in cash on the last day of the month. Company policy is to maintain an ending cash balance of at least $20,000. Use this information and the schedules produced above to prepare a cash budget