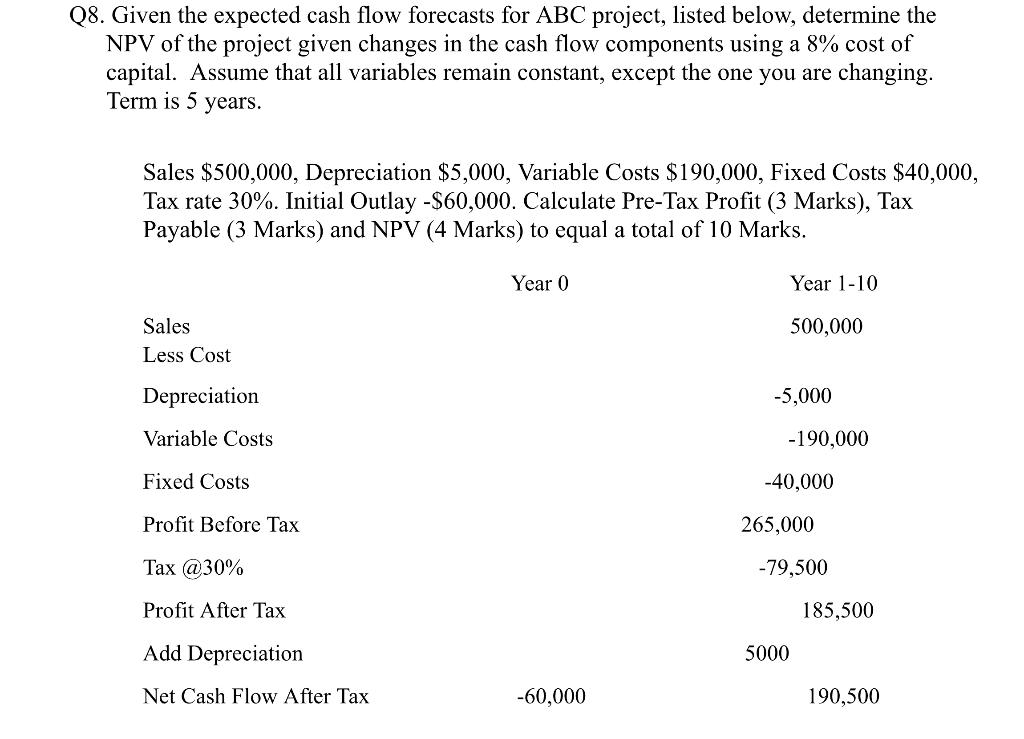

Question: 08. Given the expected cash flow forecasts for ABC project, listed below, determine the NPV of the project given changes in the cash flow components

08. Given the expected cash flow forecasts for ABC project, listed below, determine the NPV of the project given changes in the cash flow components using a 8% cost of capital. Assume that all variables remain constant, except the one you are changing. Term is 5 years. Sales $500,000, Depreciation $5,000, Variable Costs $190,000, Fixed Costs $40,000, Tax rate 30%. Initial Outlay -$60,000. Calculate Pre-Tax Profit (3 Marks), Tax Payable (3 Marks) and NPV (4 Marks) to equal a total of 10 Marks. Year 0 Year 1-10 500,000 Sales Less Cost Depreciation -5,000 Variable Costs -190,000 Fixed Costs -40,000 Profit Before Tax 265,000 Tax @30% -79,500 Profit After Tax 185,500 Add Depreciation 5000 Net Cash Flow After Tax -60,000 190,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts