Question: 4. REQUIRED: 1. Prepare an incremental cash flow analysis worksheet for each project. 2. Compute the net present value (NPV) for each project using a

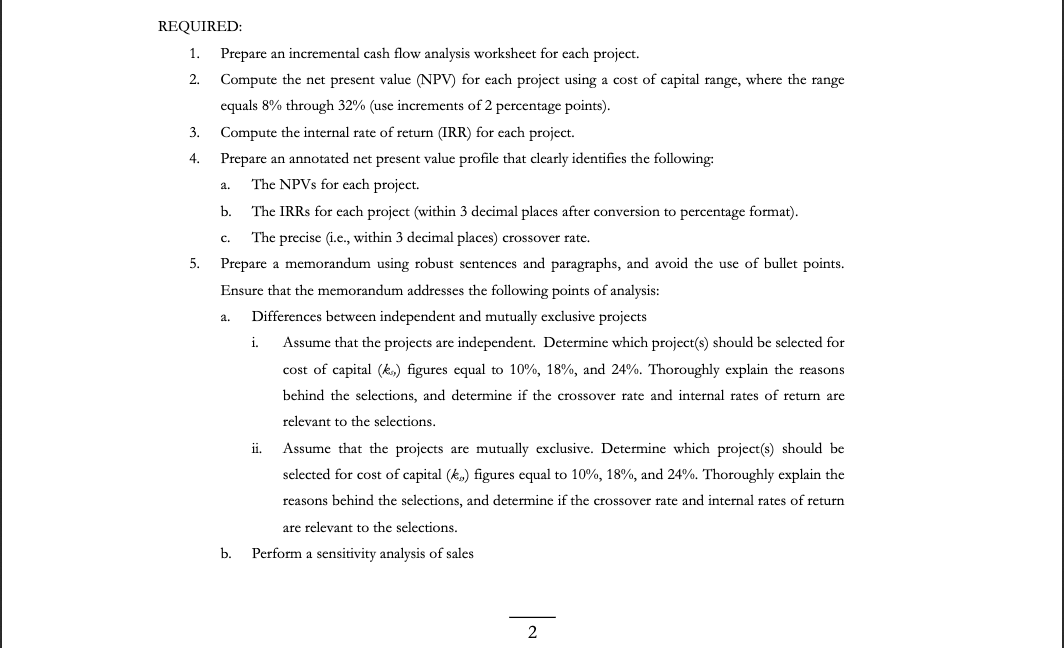

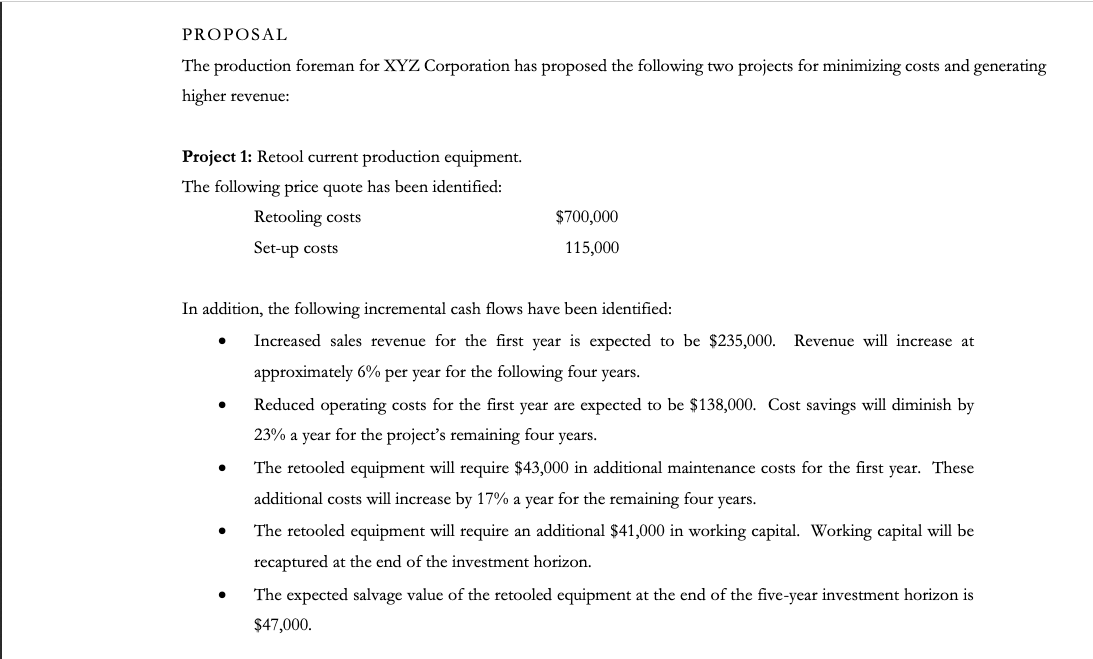

4. REQUIRED: 1. Prepare an incremental cash flow analysis worksheet for each project. 2. Compute the net present value (NPV) for each project using a cost of capital range, where the range equals 8% through 32% (use increments of 2 percentage points). 3. Compute the internal rate of return (IRR) for each project. Prepare an annotated net present value profile that clearly identifies the following: The NPVs for each project. b. The IRRs for each project (within 3 decimal places after conversion to percentage format). The precise (i.e., within 3 decimal places) crossover rate. 5. Prepare a memorandum using robust sentences and paragraphs, and avoid the use of bullet points. Ensure that the memorandum addresses the following points of analysis: Differences between independent and mutually exclusive projects Assume that the projects are independent. Determine which project(s) should be selected for cost of capital (kes) figures equal to 10%, 18%, and 24%. Thoroughly explain the reasons behind the selections, and determine if the crossover rate and internal rates of return are relevant to the selections. Assume that the projects are mutually exclusive. Determine which project() should be selected for cost of capital (key) figures equal to 10%, 18%, and 24%. Thoroughly explain the reasons behind the selections, and determine if the crossover rate and internal rates of return are relevant to the selections. b. Perform a sensitivity analysis of sales a. i. 2 PROPOSAL The production foreman for XYZ Corporation has proposed the following two projects for minimizing costs and generating higher revenue: Project 1: Retool current production equipment. The following price quote has been identified: Retooling costs Set-up costs $700,000 115,000 In addition, the following incremental cash flows have been identified: Increased sales revenue for the first year is expected to be $235,000. Revenue will increase at approximately 6% per year for the following four years. Reduced operating costs for the first year are expected to be $138,000. Cost savings will diminish by 23% a year for the project's remaining four years. The retooled equipment will require $43,000 in additional maintenance costs for the first year. These additional costs will increase by 17% a year for the remaining four years. The retooled equipment will require an additional $41,000 in working capital. Working capital will be recaptured at the end of the investment horizon, The expected salvage value of the retooled equipment at the end of the five-year investment horizon is $47,000 . 4. REQUIRED: 1. Prepare an incremental cash flow analysis worksheet for each project. 2. Compute the net present value (NPV) for each project using a cost of capital range, where the range equals 8% through 32% (use increments of 2 percentage points). 3. Compute the internal rate of return (IRR) for each project. Prepare an annotated net present value profile that clearly identifies the following: The NPVs for each project. b. The IRRs for each project (within 3 decimal places after conversion to percentage format). The precise (i.e., within 3 decimal places) crossover rate. 5. Prepare a memorandum using robust sentences and paragraphs, and avoid the use of bullet points. Ensure that the memorandum addresses the following points of analysis: Differences between independent and mutually exclusive projects Assume that the projects are independent. Determine which project(s) should be selected for cost of capital (kes) figures equal to 10%, 18%, and 24%. Thoroughly explain the reasons behind the selections, and determine if the crossover rate and internal rates of return are relevant to the selections. Assume that the projects are mutually exclusive. Determine which project() should be selected for cost of capital (key) figures equal to 10%, 18%, and 24%. Thoroughly explain the reasons behind the selections, and determine if the crossover rate and internal rates of return are relevant to the selections. b. Perform a sensitivity analysis of sales a. i. 2 PROPOSAL The production foreman for XYZ Corporation has proposed the following two projects for minimizing costs and generating higher revenue: Project 1: Retool current production equipment. The following price quote has been identified: Retooling costs Set-up costs $700,000 115,000 In addition, the following incremental cash flows have been identified: Increased sales revenue for the first year is expected to be $235,000. Revenue will increase at approximately 6% per year for the following four years. Reduced operating costs for the first year are expected to be $138,000. Cost savings will diminish by 23% a year for the project's remaining four years. The retooled equipment will require $43,000 in additional maintenance costs for the first year. These additional costs will increase by 17% a year for the remaining four years. The retooled equipment will require an additional $41,000 in working capital. Working capital will be recaptured at the end of the investment horizon, The expected salvage value of the retooled equipment at the end of the five-year investment horizon is $47,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts