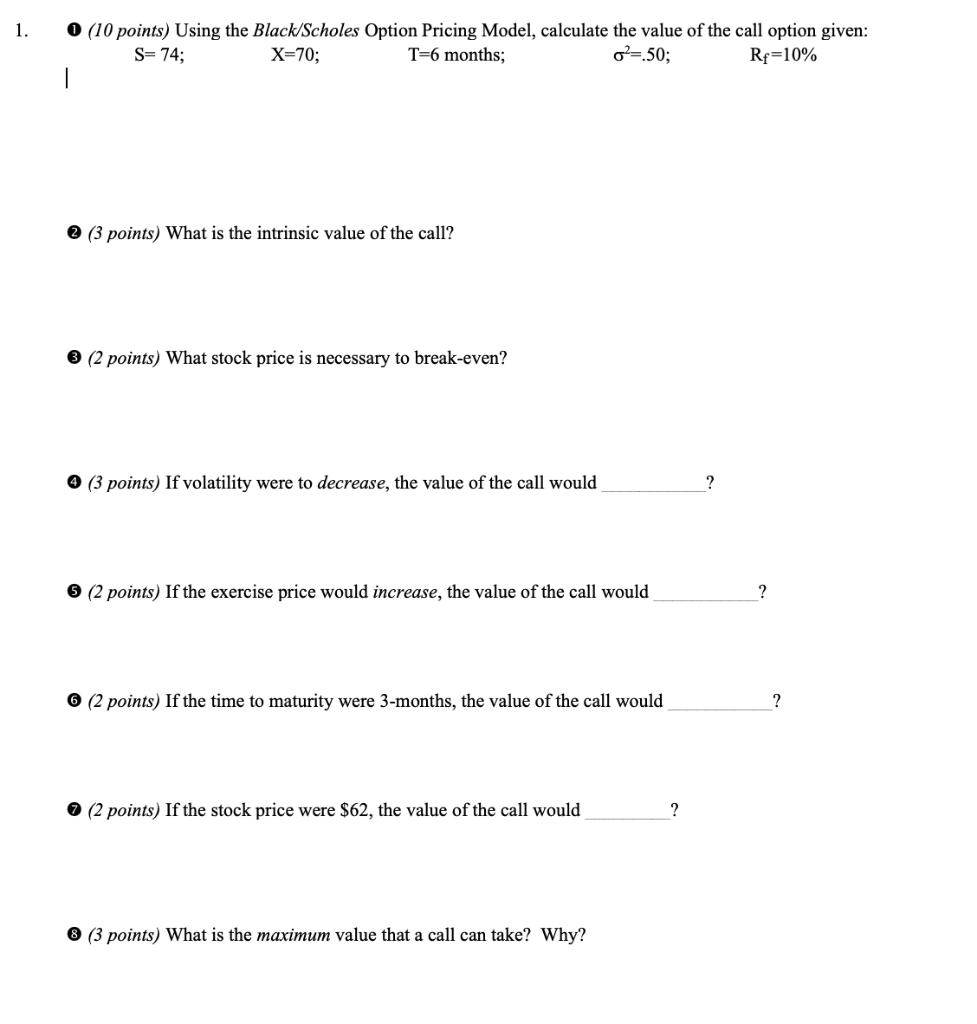

Question: 1. 0 (10 points) Using the Black/Scholes Option Pricing Model, calculate the value of the call option given: o=.50; S=74; X=70; T=6 months; Rf=10%

1. 0 (10 points) Using the Black/Scholes Option Pricing Model, calculate the value of the call option given: o=.50; S=74; X=70; T=6 months; Rf=10% 1 (3 points) What is the intrinsic value of the call? 3 (2 points) What stock price is necessary to break-even? (3 points) If volatility were to decrease, the value of the call would (2 points) If the exercise price would increase, the value of the call would 6 (2 points) If the time to maturity were 3-months, the value of the call would (2 points) If the stock price were $62, the value of the call would 8 (3 points) What is the maximum value that a call can take? Why? ? ? ? ?

Step by Step Solution

There are 3 Steps involved in it

1 Call Option Value Given the information you provided the call option value using the BlackScholes ... View full answer

Get step-by-step solutions from verified subject matter experts