Question: 1 . ( 1 0 Points ) Use the Excel file Data for Two Stocks to determine the following: a . Using EXCEL s Data

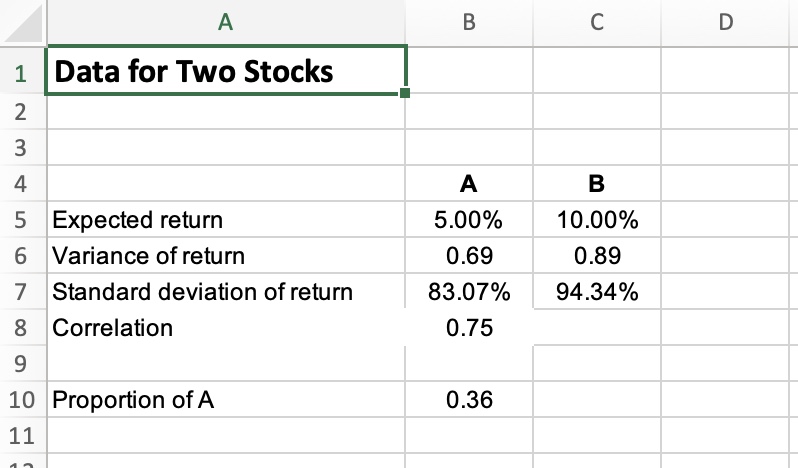

Points Use the Excel file Data for Two Stocks to determine the following:

a Using EXCELs Data Table Feature, create a oneway data table that determines the different means and standard deviations for portfolios consisting of combinations of Stock A and Stock B by varying the correlation coefficient value between Stock A and Stock B through the full range of possible correlation coefficient values. Use increments of for the possible correlation coefficient values.

b Graph the correlation coefficients, the means, and the standard deviations of the portfolios from the oneway data table. Be sure to include a title for the graph and label the axes.

c Use Excels Text Box Feature to explain how the portfolio means are affected by changing the correlation coefficient values.

d Use Excels Text Box Feature to explain how the portfolio standard deviations are affected by changing the correlation coefficient values. begintabularclccc

hline & multicolumnc A & B & C & D

hline & Data for Two Stocks & & &

hline & & & &

hline & & & &

hline & & A & B &

hline & Expected return & & &

hline & Variance of return & & &

hline & Standard deviation of return & & &

hline & Correlation & & &

hline & & & &

hline & Proportion of A & & &

hline & & & &

cline & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock