Question: 1 1 : 1 0 C 9 1 ch 0 9 Excel Student Done Problem 9 - 4 Present Value and What IT Analysis

: C

ch Excel Student

Done

Problem Present Value and "What IT Analysis

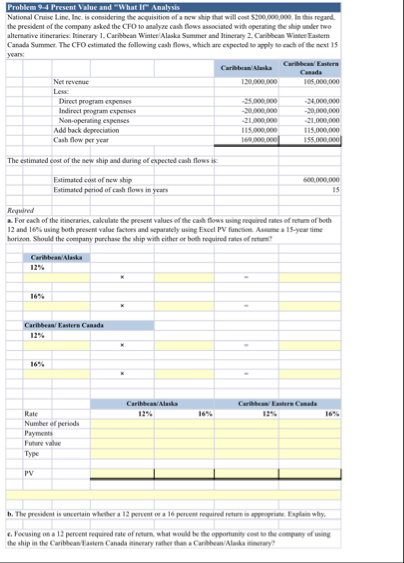

National Cruise Line, Ince. is considering the acquisition of a new ship that will cost $ In this regand. the president of the company asked the CFO to analyze cadt flows associated with operining the ship onder two alternative itineraries: Ltinerary Caribbean WinteeAlaska Summer and linerary Canlecan Winter Eavern Canada Summer. The CFO estimated the following cash flows, which are expectod ho apply to cach of the sext years:

For each of the inineraries, calculate the present values of the cadd flows uing required nates of netiurs of boch and using both present value fistoes and separately uing Eweel PV functive. Auame a year time borison. Should the company parchase the ship with either or both required rates of notern?

b The peveident is unceriain whether a percent or a percent required return is appoprime. Lyplais why.

Fecusing on a percem evquired rate of retirn, what would be the opportunity coit te the ceeppuing of uing the ship in the Caribtean Iastern Canads iniserary rather thas a CarhbeanAlaks iensriy? SHOW EXCEL FORMULAS

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock