Question: 1 1 In practice, a common way to value a share of stock when a company pays dividends is to value the dividends over the

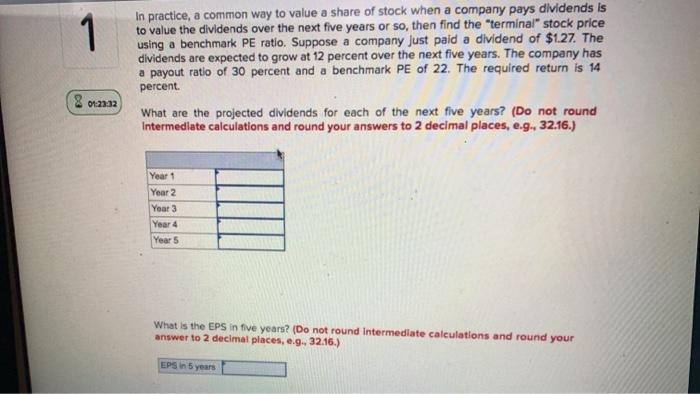

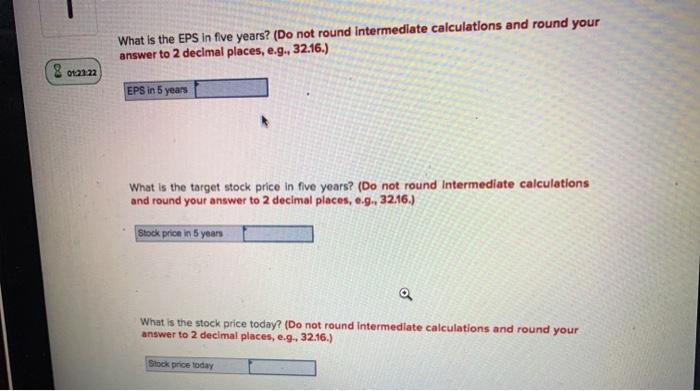

1 1 In practice, a common way to value a share of stock when a company pays dividends is to value the dividends over the next five years or so, then find the terminal" stock price using a benchmark PE ratio. Suppose a company Just paid a dividend of $1.27. The dividends are expected to grow at 12 percent over the next five years. The company has a payout ratio of 30 percent and a benchmark PE of 22. The required return is 14 percent. What are the projected dividends for each of the next five years? (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g. 32.16.) 2 Year 1 Year 2 Year 3 Year 4 Year 5 What is the EPS in five years? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g. 32:16.) EPS in 5 years What is the EPS in five years? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) 2 EPS in 5 years What is the target stock price in five years? (Do not round Intermediate calculations and round your answer to 2 decimal places, 0.9., 32,16.) Stock price in 5 years What is the stock price today? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g. 32.16.) Stock price today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts