Question: 1. (10) Using table 4-1, complete a vertical analysis of the income statement for January. 2. (10) Using table 4-1, complete a horizontal analysis for

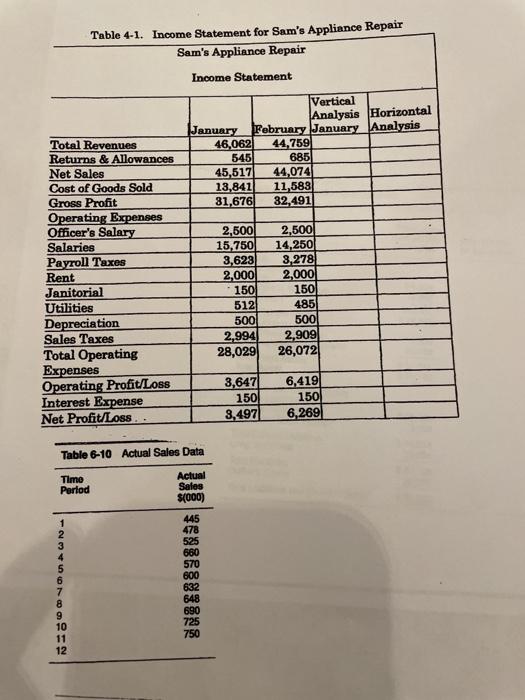

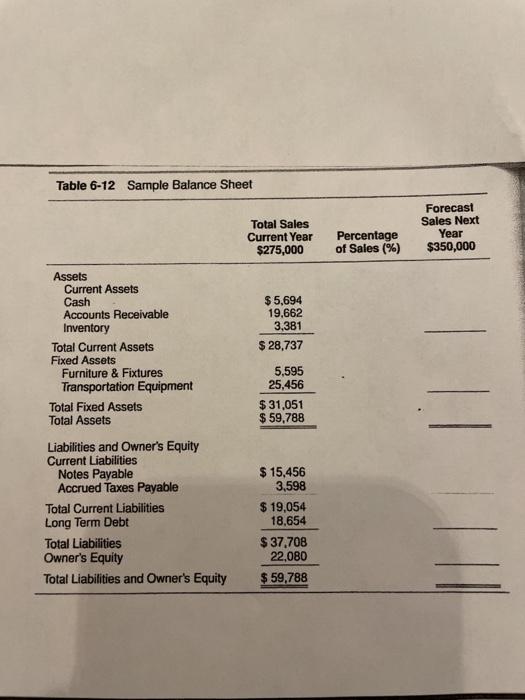

1. (10) Using table 4-1, complete a vertical analysis of the income statement for January. 2. (10) Using table 4-1, complete a horizontal analysis for Sam's Appliance Repair. Table on back page. 3. (10) Wanda wants to open a health food store. She will pay rent of $1500 per month, utilities of $500, insurance of $100 per month, and payroll of $1250. She estimates that her cost of goods will be approximately 65% of sales. Wanda would like to make $2,000 a month for herself. a. What is her contribution margin? b. How much does she need in monthly sales to break even? c. How much does she need in monthly sales to make a profit of $2,000? 4. (5) Using the data in table 6-10, calculate a three month moving average forecast for month 12. Table on back page Table 4-1. Income Statement for Sam's Appliance Repair Sam's Appliance Repair Income Statement Vertical Analysis Horizontal January February January Analysis 46,062 44,759 545 685 45,517 44,074 13,841 11,583 81,676 32.491 Total Revenues Returns & Allowances Net Sales Cost of Goods Sold Gross Profit Operating Expenses Officer's Salary Salaries Payroll Taxes Rent Janitorial Utilities Depreciation Sales Taxes Total Operating Expenses Operating Profit/Loss Interest Expense Net Profit/Loss 2,500 15,750 3,623 2,000 - 150 512 500 2,994 28,029 2,500 14,250 3,278 2,000 150 4851 500 2,909 26,072 3,647 150 3,497) 6.419 150 6,2691 Table 6-10 Actual Sales Data Time Period Actual Sales $(000) 445 478 525 1 2 3 4 5 6 7 8 9 10 11 12 | 46886883888 570 600 632 648 690 725 750 Table 6-12 Sample Balance Sheet Total Sales Current Year $275,000 Percentage of Sales (%) Forecast Sales Next Year $350,000 Assets Current Assets Cash Accounts Receivable Inventory Total Current Assets Fixed Assets Furniture & Fixtures Transportation Equipment Total Fixed Assets Total Assets $ 5,694 19,662 3,381 $ 28,737 5,595 25,456 $31.051 $ 59,788 11 Liabilities and Owner's Equity Current Liabilities Notes Payable Accrued Taxes Payable Total Current Liabilities Long Term Debt Total Liabilities Owner's Equity Total Liabilities and Owner's Equity $ 15,456 3,598 $ 19,054 18.654 $ 37,708 22.080 $ 59,788

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts