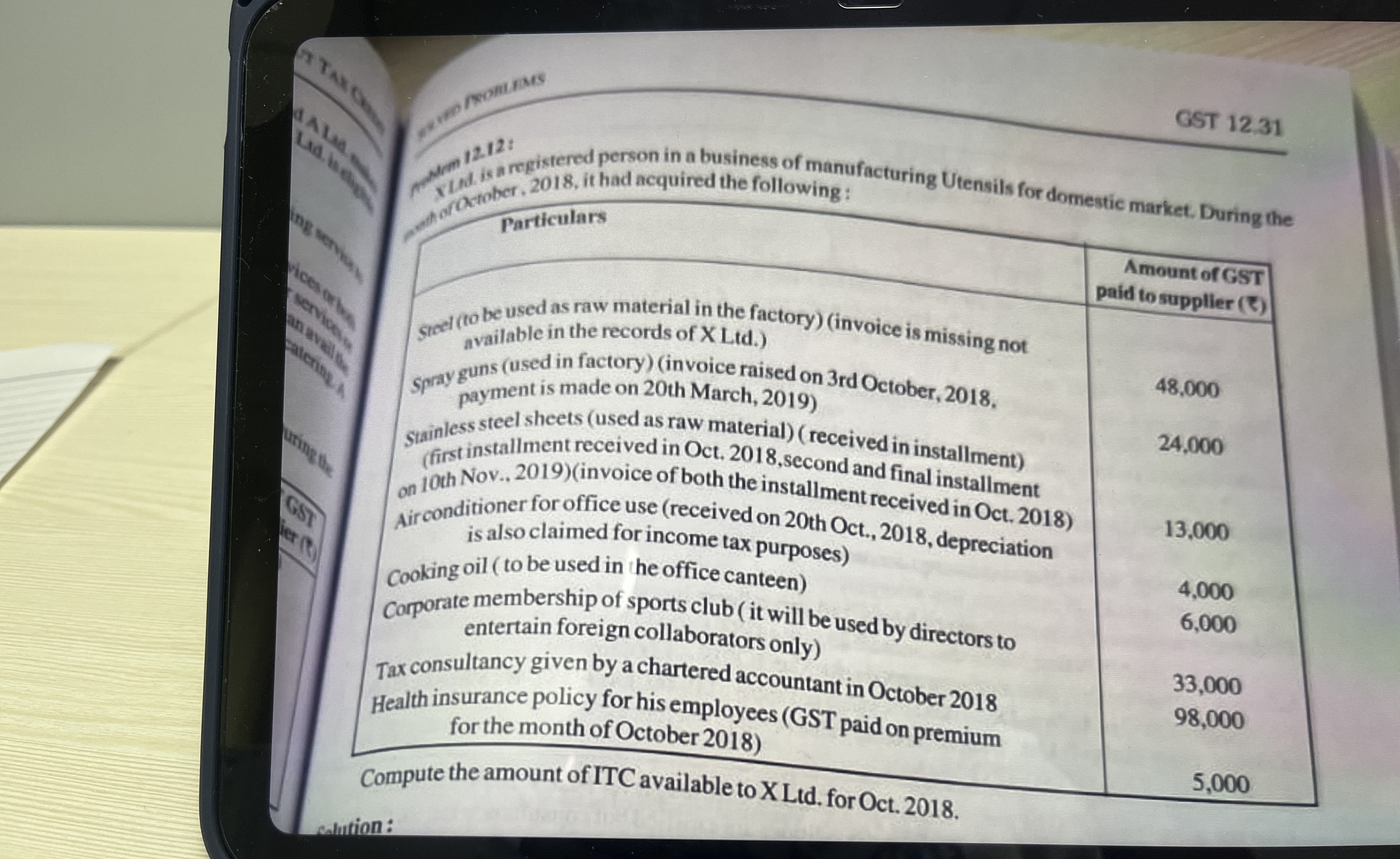

Question: 1 2 . 1 2 : atober. 2 0 1 8 , it had acquired the following: syel ( co be used as raw material

:

atober. it had acquired the following:

syel co be used as raw material in the factoryinvoice is missing not

sray

spri payment is made on th Mare raised on rd October,

stainless steel sheets used as raw March,

on th Nov., invoice of both the installment final installment

Airconditioner for office use received on th Oct

is also claimed for income tax purposes

Cooking oil to be used in the office canteen

Corporate membership of sports club it will be used by directors to

entertain foreign collaborators only

Tax consultancy given by a chartered accountant in October

Health insurance policy for his employees GST paid on premium

for the month of October

Amount of GST

paid to supplier

Compute the amount of ITC available to X Ltd for Oct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock