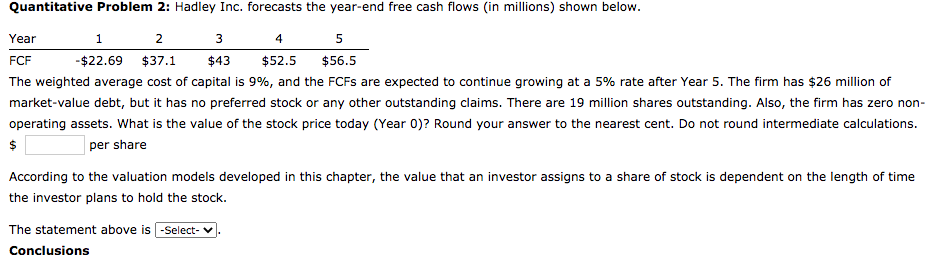

Question: 1 2 3 4 5 Quantitative Problem 2: Hadley Inc. forecasts the year-end free cash flows (in millions) shown below. Year FCF - $22.69 $37.1

1 2 3 4 5 Quantitative Problem 2: Hadley Inc. forecasts the year-end free cash flows (in millions) shown below. Year FCF - $22.69 $37.1 $43 $52.5 $56.5 The weighted average cost of capital is 9%, and the FCFs are expected to continue growing at a 5% rate after Year 5. The firm has $26 million of market-value debt, but it has no preferred stock or any other outstanding claims. There are 19 million shares outstanding. Also, the firm has zero non- operating assets. What is the value of the stock price today (Year 0)? Round your answer to the nearest cent. Do not round intermediate calculations. $ per share According to the valuation models developed in this chapter, the value that an investor assigns to a share of stock is dependent on the length of time the investor plans to hold the stock. The statement above is -Select- Conclusions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts