Question: 1. 2. 3. What continuously compounded interest rate provides the same effective return as a semiannual bond that yields 7% annually? A U.S. government bond

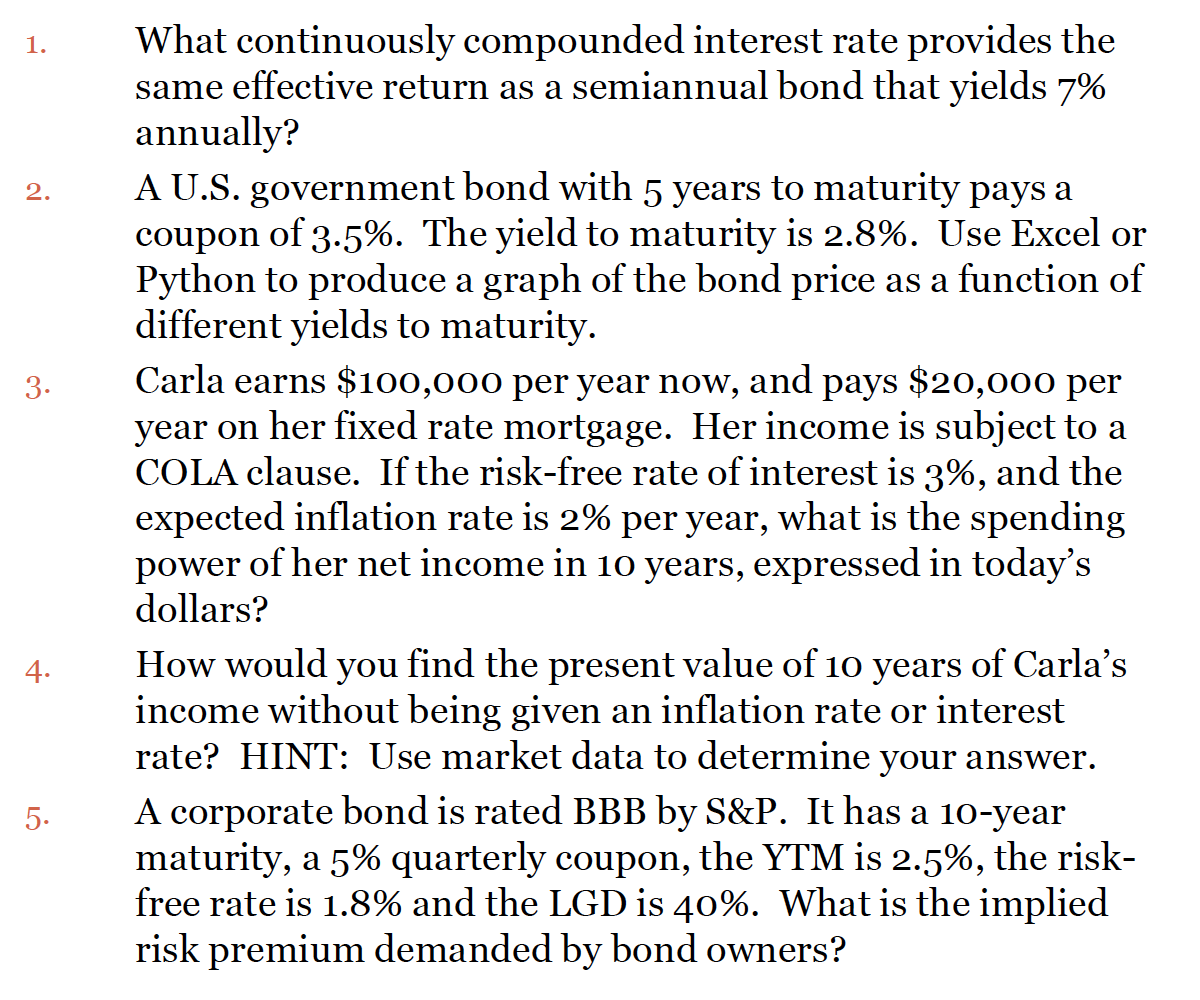

1. 2. 3. What continuously compounded interest rate provides the same effective return as a semiannual bond that yields 7% annually? A U.S. government bond with 5 years to maturity pays a coupon of 3-5%. The yield to maturity is 2.8%. Use Excel or Python to produce a graph of the bond price as a function of different yields to maturity. Carla earns $100,000 per year now, and pays $20,000 per year on her fixed rate mortgage. Her income is subject to a COLA clause. If the risk-free rate of interest is 3%, and the expected inflation rate is 2% per year, what is the spending power of her net income in 10 years, expressed in today's dollars? How would you find the present value of 10 years of Carla's income without being given an inflation rate or interest rate? HINT: Use market data to determine your answer. A corporate bond is rated BBB by S&P. It has a 10-year maturity, a 5% quarterly coupon, the YTM is 2.5%, the risk- free rate is 1.8% and the LGD is 40%. What is the implied risk premium demanded by bond owners? 4. 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts