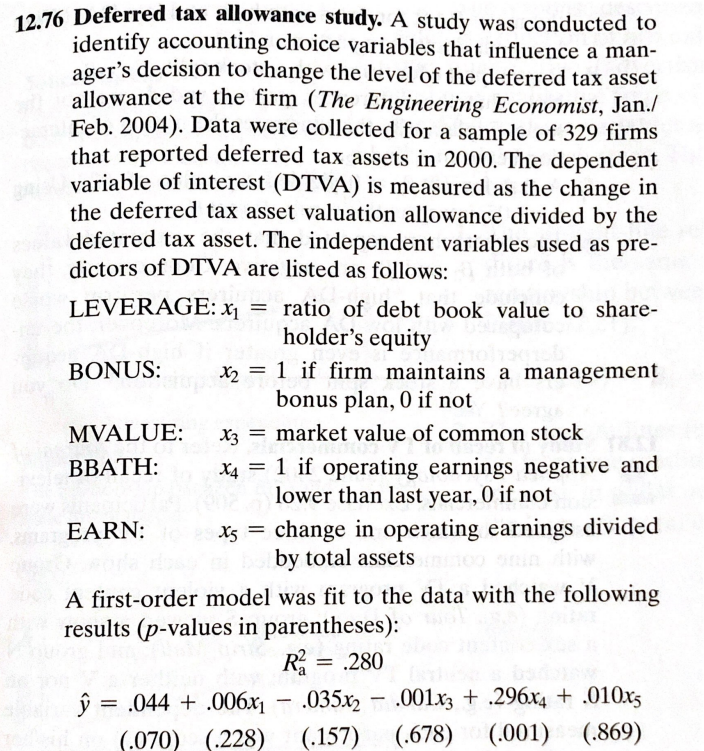

Question: 1 2 . 7 6 Deferred tax allowance study. A study was conducted t o identify accounting choice variables that influence a man - ager's

Deferred tax allowance study. A study was conducted

identify accounting choice variables that influence a man

ager's decision change the level the deferred tax asset

allowance the firm Engineering Economist, Jan

Feb. Data were collected for a sample firms

that reported deferred tax assets The dependent

variable interest measured the change

the deferred tax asset valuation allowance divided the

deferred tax asset. The independent variables used pre

dictors DTVA are listed follows:

LEVERAGE: ratio debt book value share

holder's equity

BONUS: firm maintains a management

bonus plan, not

MVALUE: market value common stock

BBATH: operating earnings negative and

lower than last year, not

EARN: values

hat

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock