Question: 12.76 Deferred tax allowance study. A study was conducted to identify accounting choice variables that influence a man- ager's decision to change the level

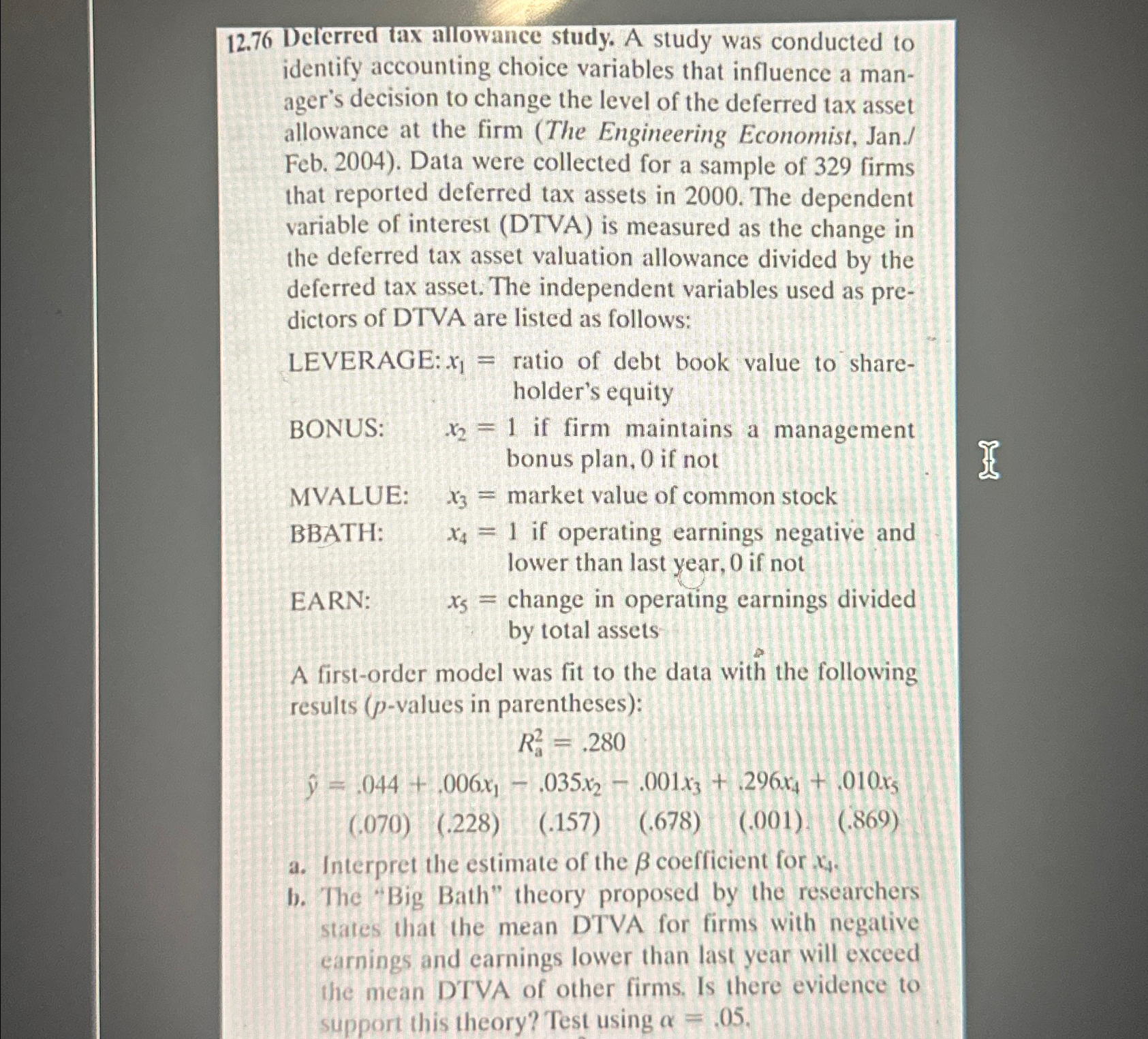

12.76 Deferred tax allowance study. A study was conducted to identify accounting choice variables that influence a man- ager's decision to change the level of the deferred tax asset allowance at the firm (The Engineering Economist, Jan./ Feb. 2004). Data were collected for a sample of 329 firms that reported deferred tax assets in 2000. The dependent variable of interest (DTVA) is measured as the change in the deferred tax asset valuation allowance divided by the deferred tax asset. The independent variables used as pre- dictors of DTVA are listed as follows: LEVERAGE: x ratio of debt book value to share- holder's equity BONUS: x2 = 1 if firm maintains a management bonus plan, 0 if not MVALUE: x3 = market value of common stock BBATH: EARN: x4 = 1 if operating earnings negative and lower than last year, 0 if not x5 change in operating earnings divided by total assets A first-order model was fit to the data with the following results (p-values in parentheses): .044+006x R = .280 .035x2.001x3 + 296x4 + .010x5 (070) (.228) (.157) (.678) (.001). (.869) a. Interpret the estimate of the coefficient for.. b. The "Big Bath" theory proposed by the researchers states that the mean DTVA for firms with negative earnings and earnings lower than last year will exceed the mean DTVA of other firms. Is there evidence to support this theory? Test using a = .05. - I

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts