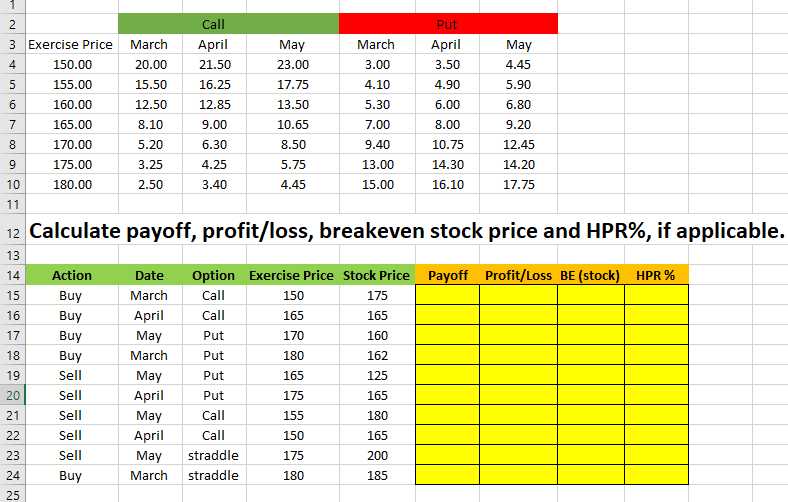

Question: 1 2 Call Put 3 Exercise Price March April May March April May 4 150.00 20.00 21.50 23.00 3.00 3.50 4.45 5 155.00 15.50

1 2 Call Put 3 Exercise Price March April May March April May 4 150.00 20.00 21.50 23.00 3.00 3.50 4.45 5 155.00 15.50 16.25 17.75 4.10 4.90 5.90 6 160.00 12.50 12.85 13.50 5.30 6.00 6.80 7 165.00 8.10 9.00 10.65 7.00 8.00 9.20 8 170.00 5.20 6.30 8.50 9.40 10.75 12.45 9 175.00 3.25 4.25 5.75 13.00 14.30 14.20 10 180.00 2.50 3.40 4.45 15.00 16.10 17.75 11 12 Calculate payoff, profit/loss, breakeven stock price and HPR%, if applicable. 13 14 Action Date Option Exercise Price Stock Price Payoff Profit/Loss BE (stock) HPR % 15 Buy March Call 150 175 16 Buy April Call 165 165 17 Buy May Put 170 160 18 Buy March Put 180 162 19 Sell May Put 165 125 20 Sell April Put 175 165 21 Sell May Call 155 180 22 Sell April Call 150 165 23 Sell May straddle 175 200 24 Buy March straddle 180 185 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts