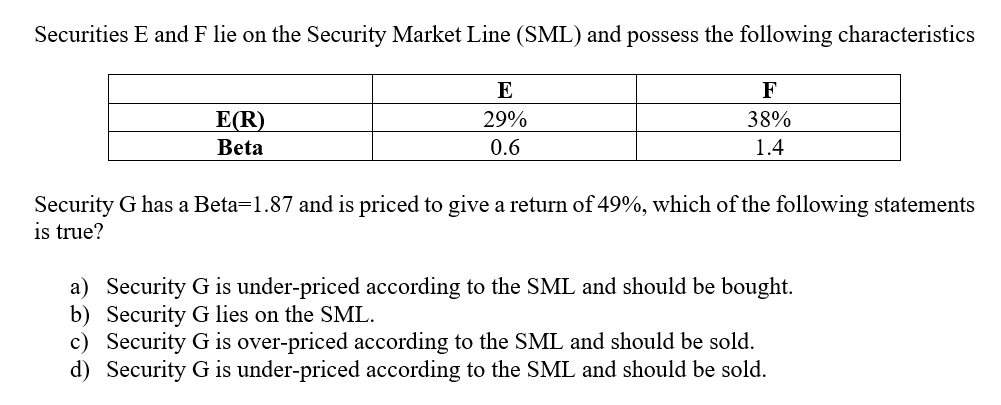

Question: 1. 2. Securities E and F lie on the Security Market Line (SML) and possess the following characteristics F E(R) Beta E 29% 0.6 38%

1.

2.

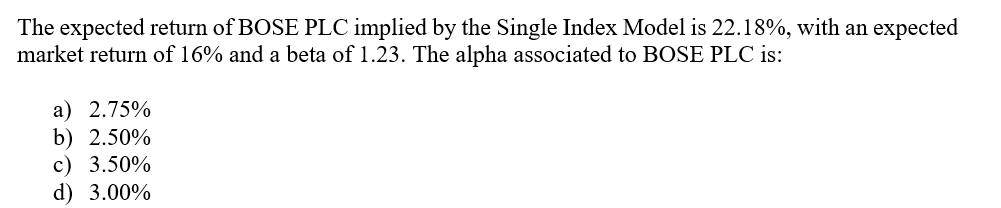

Securities E and F lie on the Security Market Line (SML) and possess the following characteristics F E(R) Beta E 29% 0.6 38% 1.4 Security G has a Beta=1.87 and is priced to give a return of 49%, which of the following statements is true? a) Security G is under-priced according to the SML and should be bought. b) Security G lies on the SML. c) Security G is over-priced according to the SML and should be sold. d) Security G is under-priced according to the SML and should be sold. The expected return of BOSE PLC implied by the Single Index Model is 22.18%, with an expected market return of 16% and a beta of 1.23. The alpha associated to BOSE PLC is: a a) 2.75% b) 2.50% c) 3.50% d) 3.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts