Question: 1. (3 points; 1 point each; no partial credit) A firm is evaluating two investment proposals. Your required minimum IRR is 18%. IRR NPV Initial

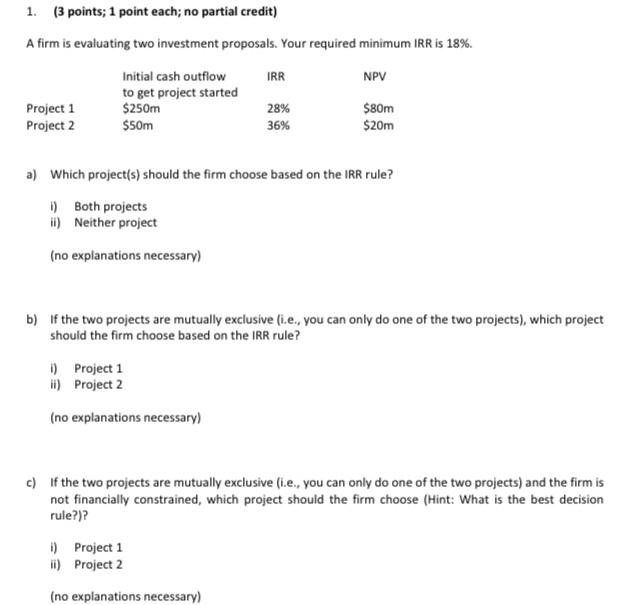

1. (3 points; 1 point each; no partial credit) A firm is evaluating two investment proposals. Your required minimum IRR is 18%. IRR NPV Initial cash outflow to get project started $250m $50m Project 1 Project 2 28% 36% $80m $20m a) Which project(s) should the firm choose based on the IRR rule? i) Both projects ii) Neither project (no explanations necessary) b) If the two projects are mutually exclusive (i.e., you can only do one of the two projects), which project should the firm choose based on the IRR rule? i) ii) Project 1 Project 2 (no explanations necessary) c) If the two projects are mutually exclusive (i.e., you can only do one of the two projects) and the firm is not financially constrained, which project should the firm choose (Hint: What is the best decision rule?)? i) ii) Project 1 Project 2 (no explanations necessary)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts