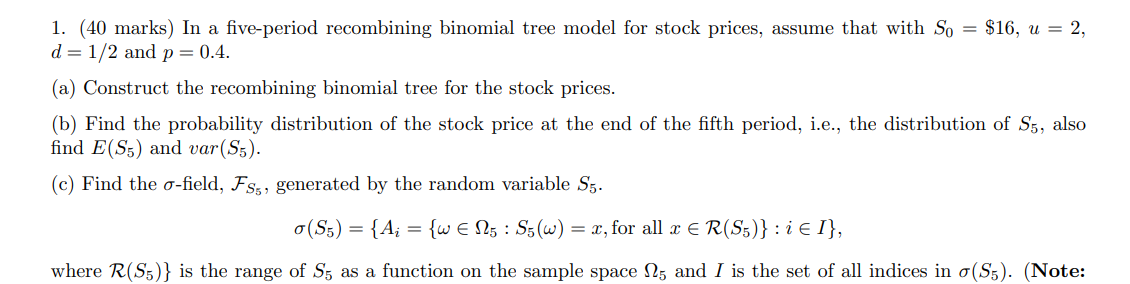

Question: 1. (40 marks) In a five-period recombining binomial tree model for stock prices, assume that with So = $16, u = 2, d=1/2 and p

1. (40 marks) In a five-period recombining binomial tree model for stock prices, assume that with So = $16, u = 2, d=1/2 and p = 0.4. (a) Construct the recombining binomial tree for the stock prices. (b) Find the probability distribution of the stock price at the end of the fifth period, i.e., the distribution of S5, also find E(S) and var(S5). (c) Find the o-field, FS, generated by the random variable S5. 0(S5) = {A; = {W 125: S5(W) = r, for all x ER(S)}:i El}, where R(S5)} is the range of S5 as a function on the sample space 15 and I is the set of all indices in o(S5). (Note: 1. (40 marks) In a five-period recombining binomial tree model for stock prices, assume that with So = $16, u = 2, d=1/2 and p = 0.4. (a) Construct the recombining binomial tree for the stock prices. (b) Find the probability distribution of the stock price at the end of the fifth period, i.e., the distribution of S5, also find E(S) and var(S5). (c) Find the o-field, FS, generated by the random variable S5. 0(S5) = {A; = {W 125: S5(W) = r, for all x ER(S)}:i El}, where R(S5)} is the range of S5 as a function on the sample space 15 and I is the set of all indices in o(S5). (

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts